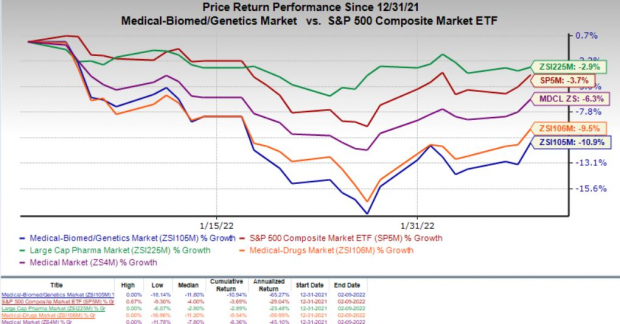

The broader market index, S&P 500, has been declining since the beginning of 2022 as economy reel under the pressure of uncertainty related to macro factors, including interest rate hike, supply chain constraints and higher inflation.

The uncertainty around the macro factors has hurt the majority of medical sector indices more than the wider market index. While S&P 500 is down 3.7% so far this year, the

Medical

sector has declined 6.3%. Within the Medical sector, the

Large Cap Pharmaceuticals

industry has declined 2.9%. The

Biomedical and Genetics

industry has declined 10.9% while the

Drugs

industry has declined 9.5% year to date.

Image Source: Zacks Investment Research

Amid this turmoil, investors can place their bets on these five big pharma and biotech companies —

Sanofi

SNY

,

AbbVie

ABBV

,

Bristol-Myers

BMY

,

Amgen

AMGN

and

Vertex Pharmaceuticals

VRTX

— that have outperformed their sector index as well as the wider Medical and S&P 500 indices.

We note that the Federal Reserve kept the federal interest rate target range unchanged in its recently-concluded meeting last month. However, the monetary policymakers for the United States have hinted at increasing the federal interest rate target range soon amid a high inflation rate. Moreover, the COVID-19 pandemic had disrupted the supply chain for companies across the globe in the past two years, hurting the delivery of raw materials as well as finished products. The supply-chain issues have resulted in lower revenues for several companies. Although the supply-chain constraint seems to ease as COVID-19 vaccines and drugs are helping to restrict the spread of infection cases, the uncertainty still lingers.

All the five companies — Sanofi, AbbVie, Bristol-Myers, Amgen and Vertex — are still in positive territory on the back of strong fundamentals, which are likely to help them thrive going forward in 2022.

While Vertex carries a Zacks Rank #2 (Buy), Sanofi, AbbVie, Bristol-Myers and Amgen carry a Zacks Rank of 3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Sanofi

Demand for Sanofi’s key drug, Dupixent was robust in 2021 driven by continued growth in atopic dermatitis and rapid uptake in asthma and chronic rhinosinusitis with nasal polyposis indications. The strong performance of the drug is likely to continue as it gains market share despite COVID-related fewer physician visits. Moreover, multiple approvals for new indications are expected in the near future.

Sanofi also possesses a leading vaccine operation, another key driver for the company’s top line.

Sanofi has several promising candidates in its pipeline with several of them in late-stage development. Study data readouts lined up for 2022 will be one of the factors driving the company’s share price. Potential approval to new drugs from Sanofi’s pipeline will boost revenues. The company’s new products are now delivering revenues greater than the loss of exclusivity impact. Moreover, Sanofi’s cost savings come from the simplification of its organization, enhanced manufacturing productivity, streamlining of products portfolio and alignment of the sales force.

Shares of SNY have gained 5.6% so far this year.

AbbVie

AbbVie has several drivers that are likely to help it deliver a robust performance going forward. First, AbbVie has been successful in expanding the labels of its cancer drugs, Imbruvica and Venclexta. These two oncology drugs have been witnessing strong demand across the majority of their approved indications, which is expected to continue in 2022, driving sales of these drugs further. Second, the company has been successfully developing two immunology drugs — Skyrizi and Rinvoq — and expanding their targeted patient population through label expansions. These two drugs are being built as a replacement for its biggest drug, Humira — which is set to lose patent exclusivity in the United States next year. The loss of exclusivity for Humira in the United States will likely dent AbbVie’s top line significantly. However, Skyrizi and Rinvoq will likely help cushion the loss. The company is also confident that these two drugs along with other key drugs will help it return to growth in 2024 following Humira’s patent loss in 2023.

Moreover, the addition of Botox with the acquisition of Allergan created a significant revenue stream for AbbVie with strong growth potential. Other key drugs like Juvederm added with the Allergan acquisition are also benefiting the company well. The rise in sales of Allergan’s drugs is likely to continue in 2022 on the back of strong demand.

Shares of ABBV have gained 5.4% so far this year.

Bristol-Myers

Bristol-Myers witnessed a recovery in 2021 as Opdivo sales returned to growth after a slowdown in 2020. The recovery in Opdivo sales is likely to continue in 2022 with a likely improvement in physician visits as well as its recent label expansion in lung cancer, renal cancer and gastric cancer. The stellar performance of key drugs, namely Revlimid and Eliquis, should sustain their strong momentum in 2022. Eliquis is the leading oral anticoagulant drug and continues to experience growth in its market share. Revlimid continues to gain from demand for triple-based therapies and increasing treatment duration.

The company has also been boosting its commercial portfolio by gaining approvals for new drugs. These new drugs are also slated to bring additional revenues for the company in 2022.

Shares of BMY have gained 6.7% so far this year.

Amgen

Amgen’s newer drugs like Prolia, Evenity and Xgeva have been witnessing an increase in sales on the back of incremental market share or label expansions. Moreover, the company reported higher sales from its biosimilar portfolio in 2021. The growth of key drugs and biosimilars is likely to continue in 2022.

Moreover, Amgen has several interesting candidates in its pipeline, which represent significant commercial potential. A promising drug, Lumakras, was approved by the FDA in May 2021 followed by the European Commission last month for treating advanced non-small cell lung cancer. This drug has the potential to bring significant revenues for the company as it targets the lucrative lung cancer market.

Recently, Amgen provided a

robust outlook

for the decade ending 2030. Amgen estimates its revenues to increase by mid-single-digit percentage points every year till 2030. The adjusted earnings are expected to exhibit a compound annual growth rate in the range of high single-digit to low double-digit percentage points in the same timeframe. The company expects its biosimilar revenues to more than double by 2030 compared with 2021 sales. The company not only has the potential to boost investors’ wealth in 2022 but can also grow wealth throughout the decade.

Shares of AMGN have gained 1.7% so far this year.

Vertex

Vertex’s cystic franchise (“CF”) has demonstrated strong growth despite the impact of the pandemic, mainly driven by its triple therapy, Trikafta/Kaftrio. Consistent positive regulatory approvals have led to the strong growth in revenues. Moreover, Vertex faces only minimal competition in its core CF franchise. We expect the company’s CF franchise performance to be stronger as the negative impacts of COVID-19 gradually wither away.

Meanwhile, Vertex has a broad clinical non-CF pipeline across six disease areas, which are progressing rapidly with data from multiple programs expected in 2022. Any positive non-CF pipeline updates will drive the company’s share price as it will create an opportunity to diversify its revenue stream.

Shares of VRTX have gained 7.5% so far this year.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report