Shares of

Zymeworks

ZYME

were up 23.6% on Dec 21 after management announced that partner

Jazz Pharmaceuticals

JAZZ

exercised an option under the

recently entered

collaboration agreement for licensing rights to the former’s lead candidate, zanidatamab.

Following the exercise of this option, Jazz will now hold exclusivedevelopment and commercialization rights to zanidatamab, Zymeworks’ lead candidate, across all its indications in all territories except in Asia/Pacific territories where the drug has already been licensed to

BeiGene

BGNE

.

Earlier this October, Zymeworks and Jazz entered into an exclusive licensing agreement to develop and market zanidatamab. Following the signing of this agreement, Jazz made an upfront payment of $50 million to Zymeworks. As part of this agreement, Jazz was granted this exclusive option if it wished to continue with the collaboration further.

In consideration for exercising the option, Jazz will pay an upfront payment of $325 million to Zymeworks. This payment will be made by Merck in fourth-quarter 2022.

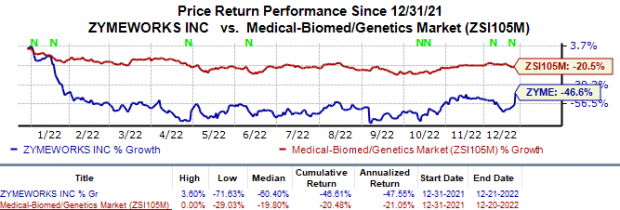

Shares of Zymeworks have lost 46.6% in the year compared to the

industry

’s 20.5% decline.

Image Source: Zacks Investment Research

Jazz’s decision to exercise its option is based on Zymeworks’ recently announced positive topline data from the pivotal phase IIb HERIZON-BTC-01 study, which evaluated zanidatamabin previously treated HER2-amplified biliary tract cancers (BTC). Data from the study showed that about 41% of study participants achieved an objective response. The median duration of response was 12.9 months. Based on this data, Jazz expects zanidatamab to become the next standard-of-care treatment in BTC.

Apart from the above payments, Zymeworks will also be eligible to receive regulatory milestone payments of up to $525 million and up to $862.5 million on the achievement of certain commercial milestones. Jazz will also be paying Zymeworks tiered royalties between 10% to 20% of the net sales if and when zanidatamab is approved and marketed. Thus, the deal has the potential to reach a total valuation of $1.76 billion.

Developed by Zymeworks, Zanidatamab is an investigational antibody candidate, which has been designed as a treatment option for patients with solid tumors that express HER2. The candidate is being evaluated by ZYME in multiple clinical studies targeting multiple oncology indications.

Apart from zanidatamab, Zymeworks is also developing zanidatamab zovodotin (ZW49) for a range of HER-2 expressing cancers. The candidate is currently undergoing a phase I study to establish its safety and antitumor activity in humans.

Zymeworks entered into a strategic collaboration with BeiGene in 2018, where the latter acquired the exclusive rights to develop and commercialize zanidatamab and zanidatamab zovodotin (ZW49) in Asia (excluding Japan), Australia and New Zealand. In return, ZYME received $40 million as an upfront payment from BeiGene. In addition, Zymeworks will also be entitled to receive development and commercial milestone payments of up to $390 million from BeiGene and potential royalties on future product sales.

Zacks Rank & Stocks to Consider

Zymeworks currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

Kamada

KMDA

, which sports a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

In the past 60 days, estimates for Kamada’s 2022 loss per share have narrowed from 14 cents to 7 cents. During the same period, the earnings estimates per share for 2023 have risen from 26 cents to 42 cents. Shares of Kamada have declined 38.2% in the year-to-date period.

Earnings of Kamada beat estimates in two of the last four quarters and missed the mark twice, witnessing a negative earnings surprise of 62.50%, on average. In the last reported quarter, Kamada’s earnings beat estimates by 433.33%.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report