Certain Information included herein contains “Forward-looking statements.” These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements.

The birds are singing and the Canadian economy is on the up and up. With so many sectors re-opening, business will not only resume to normal, it will surpass what normal was. The stocks trading under CAD$30 I’m discussing today don’t have some incredible new tech or are fueled by Reddit. Instead, they are logistics stocks.

One thing you can’t argue that almost every industry relies on?

Moving of goods.

The Great White North is a vast, beautiful place. The keyword is vast. The road to our nation’s glorious economic recovery will have many wins in multiple sectors from biotech to fintech, to materials. The one thing almost all of these industries rely on? Transport. In particular, two trucking stocks and one sea-based logistic stock under $30 are the ones to watch for and could be great pickups as we move toward recovery and beyond.

That’s why I got together my three Canadian logistics stocks under $30 that have the potential for extended growth into the future. There’s nothing insanely groundbreaking or new about them, in fact, one of them was incorporated in 1899! Yet, we like these picks because these are the kinds of companies that keep our economy moving during extended times of turmoil.

Canada’s freight and logistics market is set to grow by a CAGR of roughly 3.5% between 2020 and 2025. This leaves a lucrative opportunity for investors looking to capitalize on the global recovery from CV19. Supply chain companies are often hedged by necessity and the cost of entry. The massive growth of Canadian e-commerce from 19.8 million users in 2018 is set to go up by another 5.21 million users by 2021, with much of that set to rely on land and sea-based transportation.

Well, we are halfway there. Supply chains took a huge hit during the pandemic, but with vaccinations increasing and factories are reopening, it’s pretty obvious why the transportation sector could be a great wealth builder.

3 Incredible Canadian Transportation Stocks Under $30: Titanium Transportation Group (CVE:TTR)

Titanium Transportation Group Inc. (CVE:TTR) provides asset-based transport and logistics services in North America. They have a trucking fleet with 800 power units and 3000 trailers. The company moves full truck load and less than truck load freight all over North America, and even provides warehousing solutions. Solid fundamentals and a management team that many companies would want to have, (CVE:TTR) is well liked by analysts for a few reasons.

Analysts believe that this stock is trading at 33.% below their estimate of its fair value. A margin like that is not common in logistic stocks and gives his pick a solid pick. Their earnings are set to grow at 25.35% per year, and in the past year the stock’s earnings ballooned by 303.4%! Talk about being undervalued with some potential. A strong market cap of CA$162.1m makes this a solid potential pick for those looking for a stable small cap opportunity.

3 Incredible Canadian Transportation Stocks Under $30: Alogoma Central Corporation (TSX:ALC)

Here’s one you probably haven’t heard of. Marine transport heavyweight Algoma Central Corporation (TSE:ALC) trades at $16.82 per share and owns and operates a fleet of liquid and dry bulk carriers on the Great Lakes to St. Lawrence Waterway in Canada. The company owns 12 self-unloading bulk carriers and 8 gearless bulk carriers, along with 8 double-hull product tankers for transporting liquid petroleum products on the Great Lakes.

This stock is a virtual solid pick and one of the most established Canadian logistics companies. Another big reason to look at this stock is its solid dividend yield at 3.99%. Also, revenues in the dry bulk sector, something ALC heavily operates in, have grown 16% compared with 2020 according to the company’s Q1 report.

ALG has an amazing track record, and it should! After all, it was incorporated in 1899.

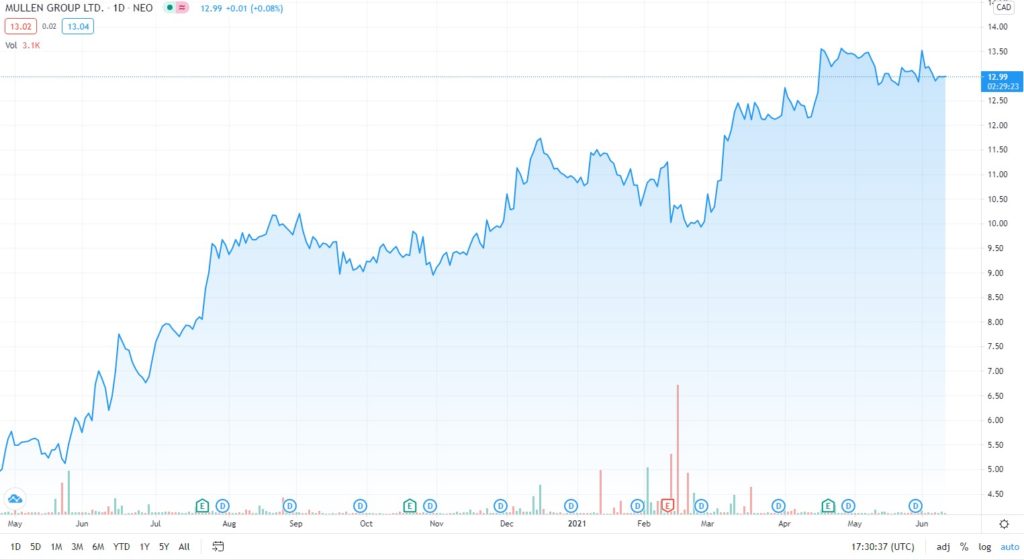

3 Incredible Canadian Transportation Stocks Under $30: Mullen Group (TSX:MTL)

One thing about Mullen Group (TSX:MTL) is the company’s stability. Although its slightly reduced revenue in the company’s 2021 Q1 report might put some people off, this stock is a very sharp player due to its acquisitions. Mullen Group acquired BC-based Bandstra Transporation Group and APPS Transport Group based in Ontario. Canada’s relatively slow rebound to re-opening hit the trucking and freight industry early this year, but with the second round of vaccinations coming in the fall, more factories will be in full operation by winter. MTL now has two new platforms to accelerate growth into the near term, making this my solid third pick.

The Takeaway

It’s good to diversify with a foundation of stocks that provide necessities. Transport is one of them, and it especially affects the auto sector.

The economy around the globe is like an Olympic sprinter with their knee to the track. When that gun fires off, it’s best to be on board, or in some cases for the above stocks, on the trucks. Logistics has always been a solid investment in Canada, which relies on trucking and sea-based transport heavily for a majority of industries.

Featured Image: Depositphotos © Nightman1965