As of late, the popularity of peer-to-peer (P2P) payments has skyrocketed, and of course, Apple (NASDAQ:$AAPL), being the world’s largest technology company, wants to be involved in the action. On June 5, 2017 Apple kicked off their 2017 Worldwide Developers Conference, which is where technology developers can attend seminars and meet face-to-face with over 1,000 Apple engineers. One of the big announcements from the conference (other than Apple creating a new Mac pro and a 10.5 inch iPad Pro) was the integration of P2P payments directly into iMessage. Funds will be saved as Apple Pay Cash, which are eligible to be spent or sent to other users. Plus, you can transfer money directly to your bank account.

The 2017 opening keynote for iOS 11 has sparked a lot of intrigue in the market, but it is important to note that, like anything, when one individual or company pulls ahead of the race, another is bound to fall behind. With that said, here are four companies who have the potential to fall behind in the race following Apple’s venture into P2P payments.

1. PayPal has the most at stake

Back in 2013, PayPal’s (NASDAQ:$PYPL) Venmo subsidiary, eBay attained Braintree, which is Venmo’s parent company. This acquisition was a part of the PayPal spin-off, which became the main P2P payment service, especially amongst younger demographics. Venmo has even obtained verb status, for instance, “Can you Venmo me $20 for dinner?”

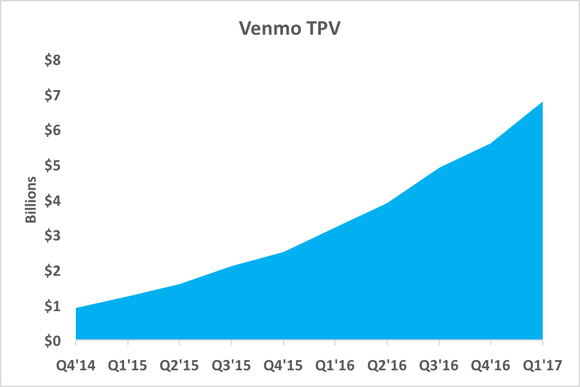

As it is measured by Venmo’s total payment volume (TPV), anyone can be a witness to Venmo’s extensive growth in usage.

Over the past four quarters, Venmo has seen $21.2 billion in total payment volume. The popularity of Venmo, especially within younger demographics, has attracted a number of investors. Plus, big name banks are now trying to catch up and tackle this popularity by partnering to create Zelle, a competing P2P payment business that was put in motion in early 2017.

Luckily for Venmo, they still have a while before they have to enter panic mode, since Venmo is a cross-platform service that is available on both Android and iOS, while P2P Apple Pay will solely be for iOS devices.

2. Apple’s P2P service was released yesterday and Square Cash is already losing revenue

In 2013, Square (NYSE:$SQ) launched their very own P2P payment service, which was mostly an e-mail based service. Since then, Square Cash’s P2P service has developed into a mobile app that can also store funds in a virtual debit card. One advantage of Square, similar to Venmo, is that their service supports both Android and iOS.

That said, Square Inc. will not openly discuss payment volumes for Square Cash, as it considers this service to be a “non-revenue generating activity.” Additionally, this service is causing problems for Square as they have been the subject of rising costs linked with the service. In 2016, costs linked to Square Cash rose $4.7 million, on top of 2015’s increase of $18 million.

3. Snap Inc.

It’s interesting to note that in 2014, Snapchat (NYSE:$SNAP) added the tool ‘Snapcash’, which processed P2P transfers using Square Cash. Partnering with Square Cash enabled Snap to avoid some of the issues that arise when operating a payment service. Plus, Snapcash is not a priority for Snapchat, which is primarily a photo and video sharing platform. To date, Snap Inc. has not vocalized about any profit from Snapcash nor is Snapcash authorized on Snapchat by default. (And I know what you’re thinking but no, your money will not disappear after 10 seconds.)

4. Facebook

One crucial aspect of Facebook’s (NASDAQ:$FB) messaging approach is through P2P payments. In 2015, Messenger added payment features, and just recently the company added options for group payment. When using messenger payments, it is required for an individual to use a regular debit card to process transfers to and from the user’s bank account.

With that said, Facebook’s messenger approach doesn’t seem completely configured for operation. It is predicted that, once Facebook builds payments processing infrastructure, they will be able to play with e-commerce by converting payments for businesses.

The advantages of Apple

Though there are a number of P2P payment competitors in the world, the ones mentioned above are the rivals that have been acquiring traction as of late.

As per usual, Apple is put at an advantage due to its ability to integrate the P2P service across their extensive portfolio of products and services. Plus, the above mentioned also gets combined with Apple’s massive user base scale.

Last but not least, it helps that Apple isn’t going to be relying on P2P Apple Play to be their profit center. Essentially Apple’s P2P will be providing a service that is secure and easy to use.

Featured Image: twitter