Big – no, massive – day for the semiconductor industry! On Tuesday, September 26, Micron Technology (NASDAQ:$MU) reported quarterly revenue and earnings that surpassed analysts’ expectations.

Let’s take a look at how the company did in comparison to what Wall Street forecasted:

– Earnings Per Share: $2.02 versus $1.83 forecasted, according to Thomson Reuters

– Revenue: $6.14 billion versus $5.96 billion expected, according to Thomson Reuters

In the 2016 quarter, Micron Technology recorded an adjusted loss per share of 1 cent on $3.22 billion in revenue.

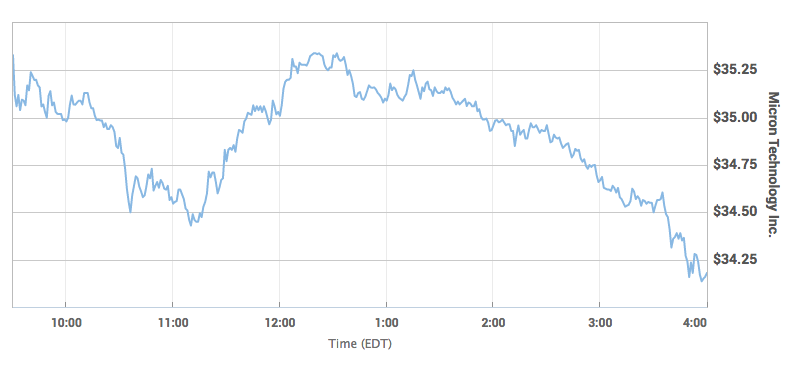

Shares of Micron Tech gained as much as 4% in the after-hours trading session.

Now that the quarterly report is out, what are people saying about Micron Technology? Well, Sanjay Mehrotra, CEO of Micron Tech, forecasts “healthy industry fundamentals to continue into 2018.” And Wall Street has said that Micron has the potential to benefit from growing demand for memory products as new tech markets continue to open up. Many speculate areas such as artificial intelligence and networking may play a role in a growing share of demand for products from Micron.

So far, analysts have been fairly optimistic about Micron. Before the closing bell Tuesday, the average price target on shares of Micron were near $44.88. This implies a roughly 29% upside.

In 2017, Micron shares have rocketed almost 60%.

Featured Image: twitter