If you’re looking for gold investment companies, you should know that, as of right now, companies that store valuables are expanding to meet the increase in demand, whether that be a safety-deposit box in London or a high-security institution in Frankfurt.

During the 2008 financial crisis, safe haven assets were sought after by investors and now, they are getting a new lease on life due to an increase in populist politics as well as a quickening of inflation. Two separate firms are planning to open vaults in Europe, which are capable of holding more than 100 million euros, or $112 million, in gold. Additionally, these firms will offer customers lower costs than exchange-traded products and protection from increasing prices.

According to Ross Norman, the chief executive officer of Sharps Pixley Ltd., “Inflation is a key concern for many of our clients.” He adds that “a safe-haven asset isn’t just about what you buy – it’s also about where you keep it.” Sharps Pixley Ltd. has a gold vault that is in walking distance from Buckingham Palace.

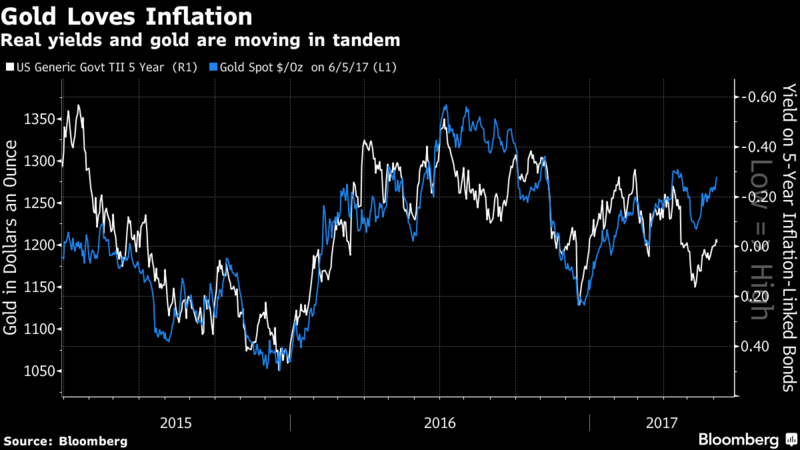

As of late, the market has had a frantic atmosphere surrounding it, and there are investors who have been thrown off by a number of political surprises, such as the UK’s decision to leave the EU and the election of Donald Trump as the 45th President of the United States. Aside from that, there have been an overload of negative interest rates that have lingered across Europe. Plus, inflation has threatened to wipe out fixed coupon payments which are offered by bonds and increasing the desire to store wealth in a dark room with tempered steel walls.

“I was just dealing with a customer here in Germany who got charged negative interest rates on his bank account,” said Daniel Marburger, the CEO of CoinInvest.com in an email to Mining.com. According to Marburger, the client wanted to purchase both gold and silver with his cash and “that is definitely a driving factor and will lead to more sales and also more storage clients.”

Currently, CoinInvest, which is a European gold dealer, is in a debate over the development of a 100 square-meter, or 1,076 square-foot, vault that has the potential to hold more than 100 million euros of gold. The safe will be quite protective, weighing 82 metric tons, with the door at 1.5 tons.

BullionVault.com, which is one of the largest online platforms for physical gold trading in the world, just added roughly 3 tons of gold in the 12 months through May. This brought their combined holdings to nearly 38 tons, which are worth $1.5 billion at current prices. According to Paul Tustain, one of BullionVaults.com’s founders, the gold is held in vaults in Zurich, New York, Toronto, and London.

At the Bank of England, which is one of the largest commercial vaults in the world, their gold in storage climb to roughly 6% since the start of last year to nearly 5,067 tons in February. The Bank of England maintains gold for the U.K Treasury as well as other banks and private companies.

Tony Dobra, who is the CEO of Baird & Co., stated that the company’s customers “are looking to park their wealth somewhere. They understand fluctuations in the gold price, but they’re comfortable with that. They know gold’s never going to go to zero.”

Baird & Co., who is the U.K’s largest gold refiner, are in the midst of opening a new vault that has steel walls that are nearly a foot thick as well as having seismometers that are meant to detect nearby digging or boring. For the purpose of security, there will be more than one person required to open the door.

It’s important to note that Baird’s London vault will only store metal that is refined by the company. As long as the metal never leaves the vault, customers can make a gold investment, hold it there, and then sell it back to Baird with same-day payment if they chose to do so. Baird will charge 0.2% of the value of gold annually, which excludes transaction costs, whereas BullionVault will charge 0.12%.

Another source for vaulting demand is a rush into ETFs which are backed by the metal. In four of the past five quarters, Bloomberg has tracked that investors have been net buyers of gold ETFs.

Keep in mind that customers aren’t just storing gold in these vaults, assets can range from paintings to 25-year old scotch, all of which are kept under lock and key.

Since the demand has never been greater than it is at this moment, Christopher Barrow, the CEO of Metropolitan Safe Deposits Ltd., says that their firm is increasing its capacity “all the time”. He adds, “We have very substantial vaults and our St.John’s Wood vault is not too far from full capacity.”

Berry Canham, who is the head of the company’s precious metals section, stated in an interview that, “I’ve been in the gold market for 30 years, and suddenly, I’ve got people asking to be on the platform I’ve never heard of. They’re coming out of the woodwork.”

Featured Image: twitter.com