According to the latest filing with the Securities and Exchange Commission (SEC), CORDA Investment Management LLC has gained a new position in Agrium Inc. (NYSE:$AGU) during Q1. As a result, the firm collected 154,810 shares of the company’s stock, all of which are valued at $14,792,000. Currently, Agrium accounts for roughly 2.2% of CORDA Investment Management LLC.’s holdings.

Keep the following in mind if you are interested in agriculture stocks or you’re looking for agribusiness companies to invest in.

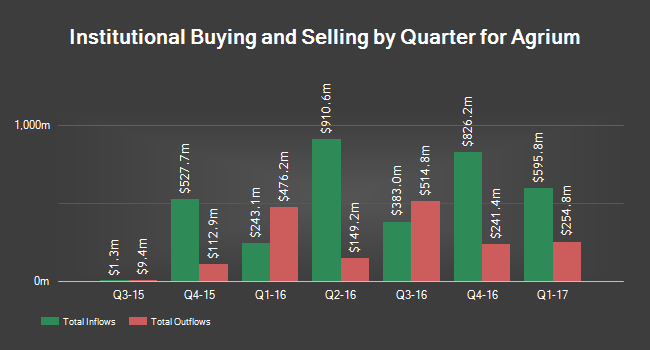

There have been a number of investors who have either added to or reduced their shares in the Calgary-based company. Advisor Group Inc., for example, increased its stake in Agrium by 10.4% in Q3. As a result, Advisor Group Inc. owns 1,362 shares of the Agrium stock (valued at $124,000) following their purchase of an additional 128 shares in the last quarter. Additionally, BB&T Securities LLC increased its stakes in Agrium by 0.9% in Q3 and the company now owns 2,730 shares (valued at $247,000) after purchasing an extra 25 shares in the last quarter. Last but not least, Creative Planning increased its stakes in Agrium by 6.1% in Q1. Respectively, Creative Planning now owns 2,746 shares (worth $262,000) after purchasing an extra 159 shares in the last quarter.

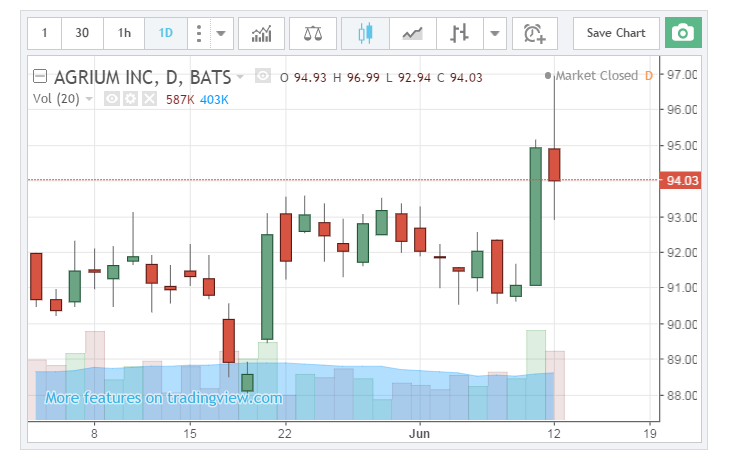

On Monday, Agrium Inc. opened at 94.95. Currently, the agriculture firm has a 12-month high of $111.88, a 12-month low of $87.62, a 50-day moving average of $91.90, and a 200 day moving average of $97.91. Agrium has a market capitalization of $13.12 billion, a P/E ratio of 22.63 and a beta of 0.67.

In addition, Agrium has recently revealed a quarterly dividend, which is required to be paid on July 20, 2017. If you are a stockholder of record, you will be paid a $0.875 dividend on July 30. This indicates a $3.50 annualized dividend and a dividend earnings of 3.69%. Remember that the ex-dividend date is June 28 and the firm’s payout ratio is 83.14%.

As mentioned, there have been investors who have been adding to or reducing their shares in the company, but, there are also numerous research firms weighing in on Agrium. The Royal Bank of Canada, for example, increased their target price on shares of the firm from $105.00 to $110.00. RBC also gave Agrium’s stock an “outperform” rating on Monday, February 13. Another example of this would be Scotiabank who decreased AGU shares from a “hold” to a “buy” on May 19. To simplify, there have only been two equities research experts who rated the stock as a “sell”, while nine gave it a “hold” rating and eight rated it as a “buy”. As we speak, Agrium’s stock has a “Hold” rating and an average target price of $103.92.

A Brief Overview: Agrium

Agrium Inc. sells agricultural products and services in a number of countries, including the United States, Canada, Australia, Argentina, Brazil, Chile, and Uruguay. The firm is also a multi-national producer and marketer of nutrients for agricultural and industrial sectors. Agrium’s sectors include both Retail and Wholesale. Starting on December 31, 2016, Agrium’s retail business unit advertised crop nutrients, crop protection products, and a number of other services through 1,500 retails locations in the seven countries mentioned above.

Featured Image: twitter