Glencore (LON:$GLEN), an Anglo-Swiss mining giant, has just signed a massive cobalt deal with Chinese producer Contemporary Amperex Technology. Essentially, this deal will help Volkswagen (FWB:$VOW) lockdown lithium-ion batteries for its electric vehicles.

On July 6, sources told Reuters that Glencore will be selling up to 20,000 tonnes of cobalt products, a key ingredient in lithium-ion batteries, to the Chinese firm.

“It was a triangular deal where Glencore, CATL and VW got round the table,” said a cobalt trader. “CATL on their own weren’t willing to commit to such a large quantity so VW said they would buy the batteries [from CATL].”

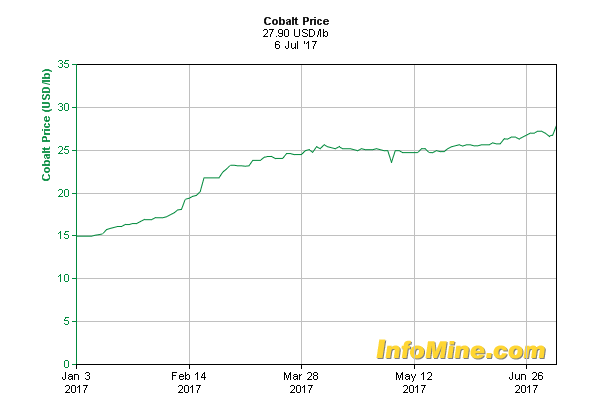

According to the same sources, the four-year contract to supply cobalt hydroxide and alloys was brought about in October of last year. At this time, cobalt metal prices were sitting at nearly $28,500 a tonne on the London Metal Exchange CBD3, and the agreement is based on prices at that level. Since then, prices for the critical metal have shot above $58,000.

As a matter of fact, prices recently reached an eight-year high. As the chart below illustrates, prices have increased more than 70% in the first six months of 2017.

If all goes as planned, Volkswagen plans to launch more than 10 electrified models by the end of 2018. Additionally, the Germany-based company is aiming to increase its electric vehicle sales to 1 million units a year by 2025; if this were to happen, this would be up from its current five-digit number.

“If the Glencore-VW deal is true, there will be huge implications for the battery market. New suppliers will need to step up fast,” said Andrew Miller of Benchmark Mineral Intelligence.

Analysts have stated that the electric car revolution is occurring much faster than once forecasted. In fact, Morgan Stanley (NYSE:$MS) said it expects global car sales to increase 50% by the year 2050 to more than 130 million units a year. Its base case is for electric cars to represent 47% of that total.

As reported by Glencore, each lithium-ion battery contains roughly 11 kilograms of cobalt, although there are a number of market participants who suspect that they have higher amounts. For instance, Cobalt Blue Holdings says 15 kilograms are needed. On the whole, demand for cobalt is forecasted to increase from 46,000 tonnes in 2016 to 76,000 tonnes by 2020.

As of right now, the majority of cobalt is produced in the Democratic Republic of Congo (DRC), however, the market is starting to worry that the supply could be at risk as the DRC is thought to be a politically unstable country. In fact, CRU Group has stated that the 1,500-tonne cobalt deficit seen in 2016 could triple by the end of 2017.

That said, opinions tend to vary as to whether producers outside of the DRC will need to step up to help increase supply. Benedikt Sobotka, the CEO of Eurasian Resources Group, said to Bloomberg, “they are all years away from production and they tend to be very small, like fantasies. They are not going to make a big difference for our industry.”

However, others speculate that output beyond the DRC could become a reality.

“There’s going to have to be a response that goes beyond Congo,” Sam Riggall, CEO of Clean TeQ Holdings (ASX:$CLQ), told Bloomberg. “[Battery producers] are desperately looking for sources of supply outside of Africa.” Currently, Clean TeQ is developing a $680-million cobalt-nickel-scandium project in Australia.

So far this year, Glencore’s share price is up 7.12%, at $297.25, while Volkswagen’s shared increased 2.46% after the news.

Featured Image: twitter