Right now, lithium, a silvery-white alkali metal, is one of the hottest assets on the planet. However, those trying to profit from it are making a crucial mistake by investing in the wrong companies. Unfortunately, the majority of investors don’t understand the logistics of investing in the metal and to their surprise, it’s lithium grade that acts as the deciding factor for who profits off of the metal.

Why is that? Well first let’s take a closer look at lithium.

Not only is lithium used to treat manic and depressive symptoms, which inspired Kurt Cobain’s song about the metal on Nirvana’s 1991 album ‘Nevermind’, lithium is also one of the most important ingredients in high-energy batteries, power storage, electric vehicles (EV), and a number of consumer electronics.

Lithium plays a defining role in the electric vehicle industry and even though the sector is experiencing hyper-growth, it’s nowhere near where it’s heading. According to Bloomberg New Energy Finance, it has been estimated that 35% of all new vehicle sales by the year 2040 will be electric vehicles. This is equal to 100 million units every year.

Tesla Inc. (NASDAQ:$TSLA) has what marketers refer to as a “halo effect”, which will make cunning investors lifetime riches as it is 100 times greater than current production. It’s true that this growth will create major supply chain challenges, but in this opportunity, the key to profitability is grade. Keep in mind that not all lithium is equal.

Major companies can increase output, but to an extent and not nearly fast enough to meet the increasing demand for the metal. Are you looking for huge gains on your lithium investments? If so, you might need to start investing in newcomers with high-quality reserves.

Mentioned previously, the best way to profit off of lithium is to watch the grade. And for this, investors should start to shift their attention to Chile, which is one of the richest sources of high-grade, low costing lithium in the world.

So what company should you invest in?

As of right now, one of the best companies to invest in is little-known miner, Bearing Resources (TSX.V:$BRZ). Bearing Resources is a junior miner and the company has just obtained the second-largest lithium project in the world, located in Chile.

So far, Bearing Resources has undertaken a $7-million exploration program which can be mined profitably. This exploration program is one of the highest-grade projects in the world, following behind the Salar de Atacama, which currently produces 100% of Chile’s lithium.

The majority of drilling is now complete, and all that remains is a feasibility study, which will be released in the early months of next year. Keep in mind that investors will not have to raise extra money as Bearing Resources has a free carry throughout the entire project.

Below are 5 reasons to keep a close eye on Bearing Resources Ltd.

1. Lithium grade trumps all

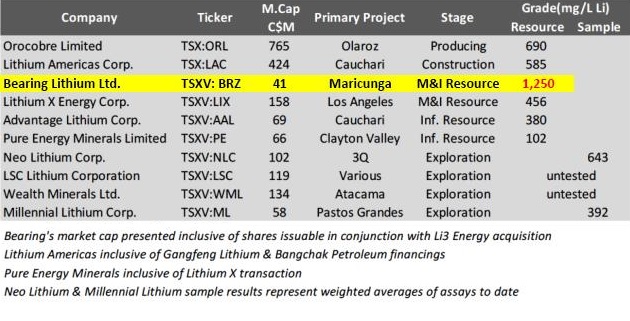

With extremely high-grade brine, Bearing’s latest resource is considered to be the highest grade undeveloped lithium brine resource in the world.

Asides from Salar de Atacama, which is located 55 km south of San Pedro de Atacama, there are no developed brine resources that come remotely close to the purity and supply of lithium in Bearing’s brine deposits.

When the project’s data was finalized, it was made known that Bearing Resource’s had the highest grade of lithium anywhere in the world outside of the Salar de Atacama. Bearing’s average lithium grade sat at 1,250 parts per million, which is roughly 2-4 times higher than any project grades in Argentina.

Under the terms of the project, Bearing Resources drilled a total of 18 holes and performed float tests, pumping tests, and built evaporation ponds. After that, the company hit ‘white petroleum’. The campaign hit on all 18 hole’s, and a number of the drill holes targeted 200 meters. In fact, one of the holes was roughly 360 meters and it rest in high-grade lithium. If all goes as planned, Bearing Resource’s new reserve will be complete in July, and executives estimate that this reserve will double Bearing’s current reserves.

If you are an electric vehicle manufacturer, you should be looking at high-grade lithium producers as this will help to keep battery output costs relatively low.

A prime example of this would be to look at what’s been happening in China as of late. Battery-grade lithium prices in China surpassed $20,000 per tonne last year, which is considerably higher than the global average. China, the biggest Li-ion battery manufacturer in the world, used to get it’s lithium from Australia, however, falling prices of electric vehicles has led it to look elsewhere for cheaper sources of the metal. Once again, we go back to Chile.

Australia and China differ from how they extract lithium as Australia extracts from hard-rock mines, while Chile mines lithium from brines that are located below accessible salt flats. The Atacama salt flat in Chile, for instance, provides 37% of the globe’s entire lithium output.

Both Chinese and Korean investors have already discussed with the Chilean government about opening a $2 billion lithium battery plant in order to take advantage of Chile’s lithium rich reserves. If, however, this comes about, there could be even more competition for the metal – especially if China starts to hoard lithium.

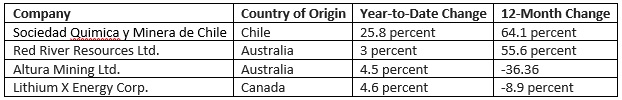

As a result, publicly-listed lithium mining companies in China have outperformed lithium mining companies in other countries.

2. Bearing Resources has low costs

Along with being high-grade, Bearing Resources is low cost. Why? Because the resource is high-quality and very close to crucial infrastructure. For example, a number of lithium mines are located in Australia’s outback, which, as one might assume, increases mining and operational expenses as the outback is extremely remote. Luckily for Bearing Resources investors, this new project is next to an International Highway, which is equipped with grid power.

Additionally, the flow rates from the pump testing conducted at the new reserve sit amongst the highest values in South America. Essentially this will help keep expenses lower and profits higher. And if you’re an electric vehicle producer, you know first hand just how important low output costs are.

In regards to electric manufacturing expenses, most of these costs come from batteries and powertrains. As a result, electric vehicles tend to be higher in price than they could or should be. That said, there have been significant breakthroughs in battery technology which helped to lower expenses. In fact, thanks to these breakthroughs lowering costs, Tesla Inc. is now able to offer the Model 3 vehicle for $35,000, which is half the price of the Model S vehicle.

Since recoverable lithium deposits are limited in number and electric vehicles want to lower their output expenses, high-grade, low-cost lithium manufacturers like Bearing Resources will be extremely desired.

3. Chile has the richest (and largest) lithium deposits in the world

Chile is home to the salt pans of the Atacama Desert, which is the driest non-polar desert in the world. Surprisingly, these are ideal conditions extract lithium.

Keep in mind that Chile might be known as the ‘Saudi Arabia of Lithium’, but, obtaining permits and concessions is far from easy. The Chilean government can be quite reluctant when issuing permits for lithium-mining in their country, so it can be hard for companies to get their foot in the door. But that wasn’t the case for Bearing Resources.

Bearing Resources has already obtained a number of concessions, thus giving the company a competitive edge over their rivals who are only now trying to get their foot in Chile’s door.

4. Bearing Resources has a top-notch team

Bearing Resources has a first-rate team with a substantiate track record. Additionally, Bearing has collaborations that have power in Chile and in the lithium supply sector.

Posco, for instance, is one of the largest steel companies in the world, and it has thus far sunk $18 million into Li3 Energy, which is a company Bearing Resources is obtaining. Additionally, Li3 Energy has brought its lithium technology to the acquisition, thus allowing the project to become one of the most profitable lithium projects worldwide. Li3 Energy’s technology tested at 88% recovery rate, which is double the traditional sector standard of 40% to 60%.

All in all, Bearing Resources has forming relationships with important players in the bag.

5. There will be a massive announcement disclosed soon

Bearing Resources is in the final stretch of closing a deal for a new project and when this happens, the company will disclose it to investors.

As mentioned, lithium grade is the key to making profits in lithium, and with first-rate partnerships and state-of-the-art production methods, Bearing Resources is on it’s way to becoming the lowest-cost producer in the lithium sector. This isn’t a long-term forecast either, this is a near-term output timeline, which puts Bearing in position for a nice channel of customers.

The world needs a massive lithium supply incline

The demand for lithium has become overpowering as of late and the consensus is that we are verging a major lithium deficit. As of right now, global lithium-ion cell output can only supply 900,000-1 million EVs.

At the time of writing, Tesla is on it’s way to commencing production of the Model 3 vehicle and the California-based company has already accumulated 373,000 reservations.

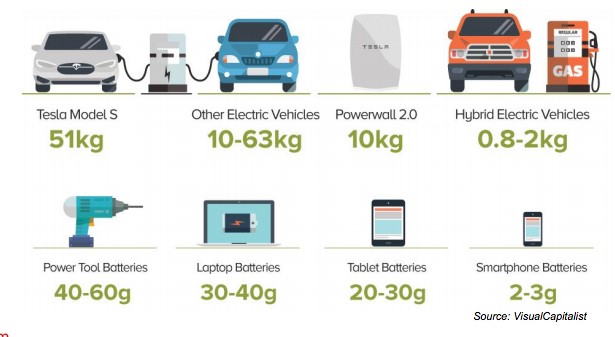

If all goes as planned, Tesla plans to manufacture 500,000 Model 3s per year by the end of next year. The automaker company could also reach a million units by the year 2020. Furthermore, Tesla sells home and industrial energy products, which include Powerwalls. Roughly 51 kg of lithium goes into each Model S vehicle and every Powerwall 2.0 unit carries 10 kgs of lithium.

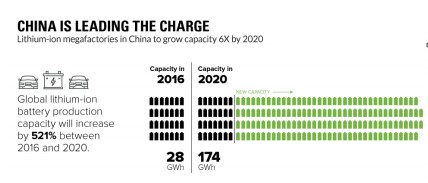

It has been estimated that global output will increase by more than 500% between 2016 and 2020, with China doing most of the grunt work.

Just keep in mind that even though there is a major opportunity for investors here, it’s not necessarily a blanket opportunity. Remember that lithium grade is the deciding factor for who gets rich in the lithium industry.

If not Bearing Resources, here are 8 other companies worth keeping an eye on:

- Lithium Americas Corp. (TSX:$LAC): LAC is a lithium mining junior who is working to create a 50/50 joint venture with Sociedad Química y Minera (NYSE:$SQM) to create the Cauchari-Olaroz Lithium brine deposit.

- Neo Lithium Corp. (TSXV:$NLC): NLC entered the game last year but they already operate the 3Q lithium brine project, known for having low impurities.

- Orocobre Limited (TSX:$ORL): Known for having first-mover advantage in Argentina’s Salar de Olaroz project, ORL is an Australian-based lithium miner.

- FMC (NYSE:$FMC): FMC Corp. plans to increase hydroxide output from 10,000 metric tonnes in 2016 to 18,000 metric tonnes in 2017.

- Albemarle Corp. (NYSE:$ALB): The Louisiana-based company owns brine deposits in both the United States and Chile. They also own a 49% share in the Greenbushes mine in Australia. Albemarle plans to double output by 2019 in order to reach 1.34 million tonnes.

- General Motors (NYSE:$GM): Despite GM’s market cap being beaten by Tesla, the company is still ahead of the Big 3 car manufacturers from Detroit in regards to self driving cars and electric vehicles.

- Magna International (TSX:$MG) (NYSE:$MGA): The Ontario-based company plans to produce elements of the electric drivetrain and contract manufacturing. If you’re a forward-thinking shareholder, MGA is a good choice.

- Lundin Mining (TSX:$LUN): Operating in Chile, Lundin is one of the best mining administrations in the world. It also mines cobalt, which is another key ingredient to lithium-ion batteries.

Featured Image: twitter