If you’ve been thinking about diving into online media investing or social media investing, you might find the following interesting: Based on filings released on Friday, Dan Loeb, founder and chief executive of Third Point, has liquidated his stake in social media company Snap, Inc. (NYSE:$SNAP) as of June 30.

Loeb still owned 2.25 million shares of Snap as of March 31, 2017, but the billionaire did not purchase any more shares of the stock as of June, according to his 13-F filing. Meanwhile, the hedge fund founder did purchase more shares of Facebook (NASDAQ:$FB) – Snap’s direct competitor – increasing his stake from 3 million shares to 3.5 million shares between the two quarters.

In addition, Loeb also purchased a 4.5 million share stake in Chinese e-commerce giant Alibaba Group Holding (NYSE:$BABA) and increased his Bank of America Corp. (NYSE:$BAC) investment from 13.5 million shares to 15 million shares.

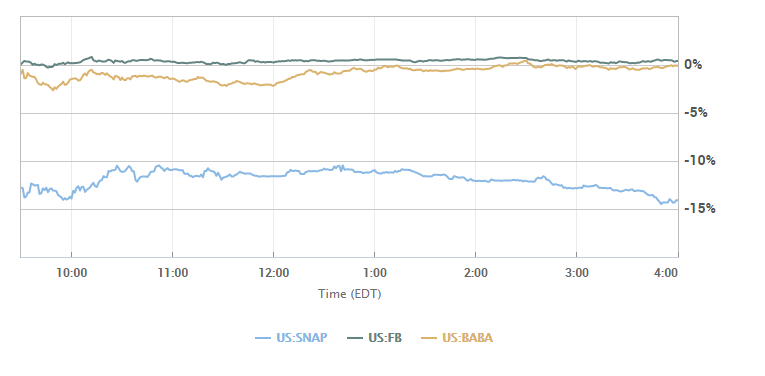

On Friday, in after hours trade, Snap shares were down 14%. And no, it is not a coincidence the stock plummeted just one day after it missed Q2 earnings expectations.

While Snap has seen recent losses, reflected in the fact that the company’s shares have taken a 30% hit since its March IPO, Third Point has been performing well, as its total returns for the year are at 10.7%.

Featured Image: twitter