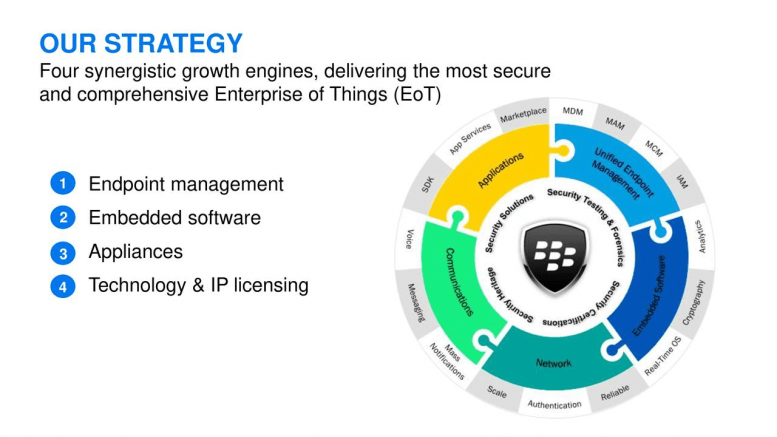

BlackBerry Ltd. (NYSE:BB): BlackBerry’s restructuring strategy of moving their business model towards software and services businesses continues generating positive results for the company and its shareholders. The company has been expanding their securing and managing IoT endpoints through investments in organic and non-organic growth opportunities.

BlackBerry’s Restructuring Strategy is Well Accepted by the Public

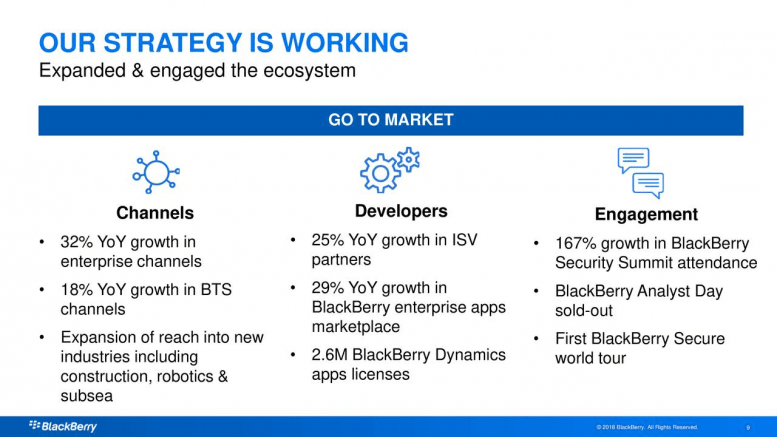

Investors have applauded BlackBerry’s restructuring strategy of moving the business model from Smartphone to software and services. BlackBerry’s share price rose 55% since the beginning of 2017, and it is up 5% over the last twelve months.

BB shares are currently trading around $10 a share, just shy from the 52-week high of $14 a share it had hit at the beginning of this year.

Software and Services Revenues are Expanding at Double-Digit Rate

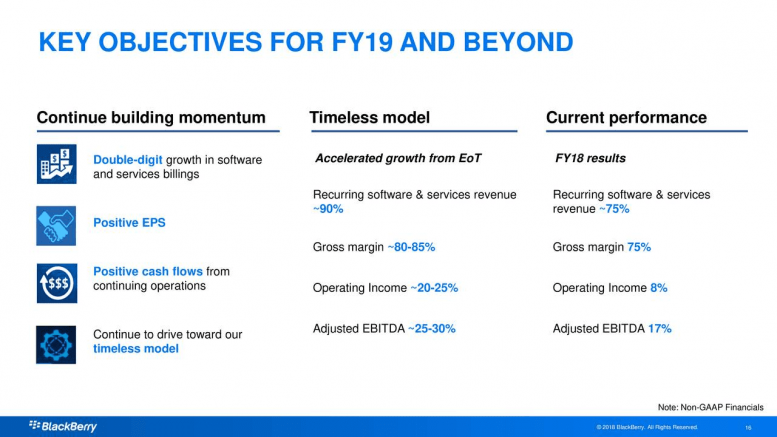

Although its first-quarter revenue fell 11% from the previous year, the company’s total non-GAAP software and services revenue jumped 14% to $193 million. After Blackberry’s restructuring strategy, its software and services revenue accounted for almost 86% of its total revenue in the first quarter, higher than the 70% in the same period last year.

BlackBerry’s automotive portfolio continues generating solid results for the company. It has recently introduced three new safety-certified products while the company believes its QNX software is generating higher than expected results.

John Chen, Executive Chairman and CEO of BlackBerry, said, “I am pleased that BlackBerry QNX software is now embedded in over 120 million automobiles worldwide, doubling the install base in the last three years. We are very excited about the opportunities ahead of us in automobiles and other EoT verticals.“

>> Intel Corp Is Set to Break Previous Records in Fiscal 2018

BlackBerry’s non-GAAP operating income was standing at around $12 million in the first quarter, the ninth straight quarter of positive operating income.

Outlook is Stable

The company expects to generate double-digit growth from its software and services billings in fiscal 2018. BlackBerry also expects to generate positive earnings per share and free cash flows this year, supported by increasing revenue base from its software segment. With $2.3 billion in cash & cash equivalents and the potential to generate positive cash flows, BlackBerry appears to be in a stable position to invest in growth opportunities.

Featured Image: Twitter