Boeing shares plunged significantly in the last two weeks amid escalating trade war tensions between the two largest economies. Traders believe that Boeing stands at the front line of the China-US trade war conflict as China is amongst the biggest customer of Boeing.

The Boeing Company (NYSE:BA) share price declined more than 8% in the last two weeks after hitting the all-time high of $370 at the beginning of this month. Its share price currently trades around $331 – with the market cap of $192 billion. Some analysts, however, are seeing the dip in Boeing shares as buying opportunity. They believe the trade war wouldn’t have a huge impact on its future fundamentals.

Boeing Shares Fall: Is it a Buying Opportunity?

Barclays analyst David Strauss, for instance, issued a price target of $400 with a ‘Buy’ rating, saying that “the company is still in the early days of benefiting from a heightened focus on cost reduction and improved productivity that will boost margins and free cash flow.”

The analyst further claims that Boeing has the potential to generate $30/share in free cash flow by 2020. He also expects the company’s free cash flow generation to double this year compared to the same time last year.

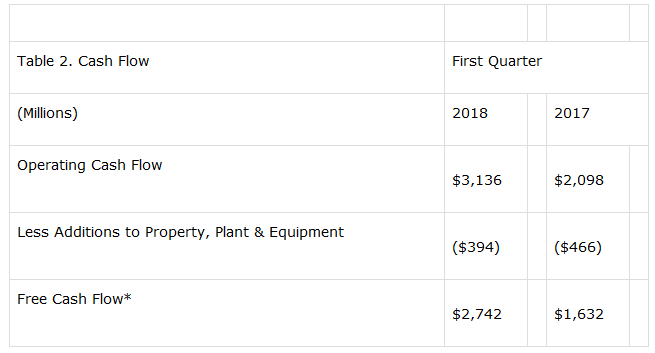

David Strauss’ claim looks quite achievable considering the robust growth in Boeing’s financial numbers, as well as its order backlog. The company’s earnings per share jumped 68% on revenue growth of only 6%. The significant earnings growth indicates that its strategy of reducing costs and improving margins is working. Its operating and free cash flows rose more than 60% from the previous year, thanks to higher earnings.

>> Micron Shares Plummeted Sharply from All-Time High Amid Trade War

Outlook is Stable Despite Trade War Worries

The Boeing Company has increased its forecast for this year based on strong results in the first quarter. The company expects a core EPS of $14.30-$14.50 compared to the previous guidance of $13.80-$14.00. Its order backlog has been increasing quarter over quarter. The company recently received an order worth $5.6B for twenty 787-9 Dreamliners.

Featured Image: Twitter