Before you invest in a company, you should first look to see what the company’s market capitalization is. On top of that, you should see whether or not the company has increased or decreased their dividends. Why is this important? Because a declining dividend payout suggests deteriorating financial health since companies are unable to afford to pay investors substantial dividend payments.

Here are four Canadian small caps that have decreased their dividends over the course of the last five years.

-

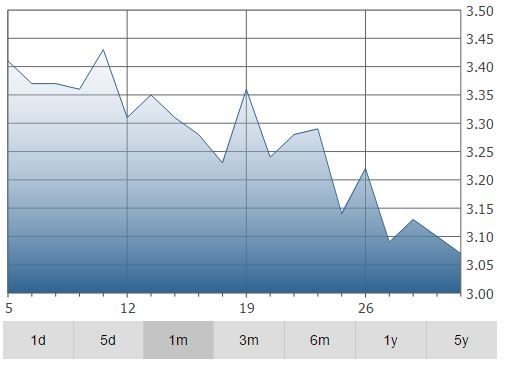

Atlantic Power Corp. (TSX:$ATP)

Atlantic Power both owns and operates a number of power generation assets in the United States and Canada. These power generation projects sell electricity to utilities and other commercial customers. Atlantic Power’s divisions include East United States, West United States, and Canada. As of December 31, 2016, Atlantic Power’s portfolio consists of interests in 19 operational power generation projects across nine states in the United States and two provinces in Canada.

- The market capitalization is $357,211,440

- The year to date price change is -8.3%

- The 5-year change in dividend yield is -100%

-

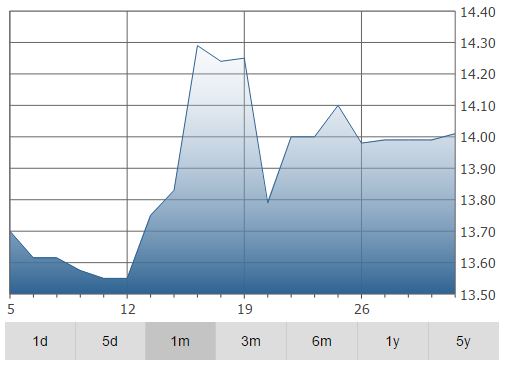

HNZ Group Inc. (TSX:$HNZ)

This Canadian company is an international provider of helicopter transportation and related support services. HNZ Group Inc. has operations in Canada, New Zealand, Australia, and Southeast Asia. The company works through four divisions: onshore helicopter transportation services, offshore helicopter transportation services, helicopter repair and maintenance, and other services such as flight training and aircraft leasing. HNZ Group Inc. operates through roughly 115 helicopters to support offshore and onshore charter activities. It helps a range of multinational companies and government agencies, such as onshore and offshore oil and gas, military support, mineral exploration, hydro and utilities, forest management, construction, air ambulance and search and rescue.

- The market capitalization is $181,439,531

- The year to date price change is 4.3%

- The 5-year change in dividend yield is -100%

-

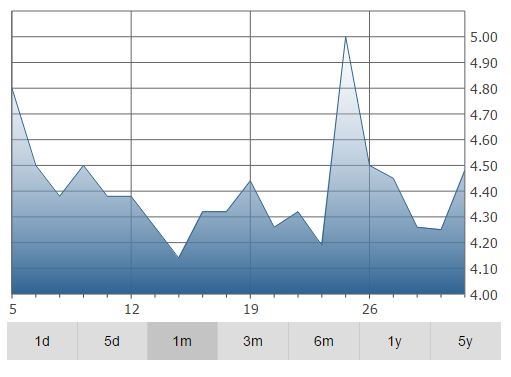

Temple Hotels Inc. (TSX:$TPH)

As one might have guessed from the name, Temple Hotels Inc. owns and operates hotel property investments in Canada. As of right now, the company’s main divisions include Fort McMurray, Other Alberta, and Other Canada.

What does it mean to operate hotel property investments? Well, the company will invest, either directly or indirectly, in hotel properties and assets. For the most part, Temple Hotel Inc.’s primary business activity is the acquisition and development of hotel properties and the management of these acquired/developed properties. Temple’s hotel portfolio consists of more than 30 hotels and investment properties, which are all owned by the company, which have roughly 3,880 rooms. Within their hotel portfolio there are two extended-stay properties (Stanton Suites Hotel, Yellowknife, and Clearwater Timberlea) and one investment property (Cortona Residence).

- The market capitalization is $107,397,274

- The year to date price change is 1.2%

- The 5-year change in dividend yield is -81%

-

Torstar Corp. (TSX:$TS.B)

Torstar Corp. is a media company based in Canada which operates through three divisions: Metroland Media Group (MMG), Star Media Group (SMG) and Digital Ventures. MMG is in charge of publishing The Hamilton Spectator and the Waterloo Region Record daily newspaper and over 100 weekly community newspapers. SMG includes the daily Toronto Star newspaper, Toronto Star Touch, and thestar.com. Star Media Group is also in charge of Free Daily News Group Inc. Last but not least, Digital Ventures includes eyeReturn Marketing Inc. and its joint venture interest in Workopolis.

- The market capitalization is $106,440,300

- The year to date price change is -21.5%

- The 5-year change in dividend yield is -74.3%

Featured Image: depositphotos/pogonici