Are you looking for agribusiness companies? Or are you thinking about investing in agriculture stocks? If you answered yes to either question, you should probably know that Zacks Investment Research downgraded Archer-Daniels-Midland Company (NYSE:$ADM) from a “hold” rating to a “strong sell” rating on May 31.

As stated by Zacks Investment Research, which is one of the top investment research firms in the world, “archer daniels has underperformed the broader industry in the last three months, largely accountable to the company’s dismal sales surprise history. The company recently released first-quarter 2017 results, wherein both earnings and sales lagged estimates. While this marked Archer Daniels’ second straight miss, the company has been missing sales estimates for over three years now. Nonetheless, results grew year over year backed by robust Agricultural Services performance, solid Corn Processing business, improved Asian results that drove Oilseeds operating profit and continued growth in Wild Flavors space. Moreover, the company’s run-rate savings in first quarter reflect that it is on track with its 2017 target. However, fluctuating commodity prices, oversupply in the industry and unfavorable margins remain concerns. Also, Glencore’s plan to expand in the agriculture space may increase competition for Archer Daniels.”

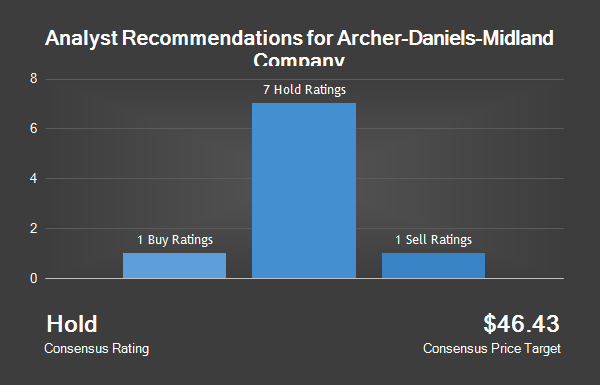

Additionally, there have been a number of equities research experts who have published reports focusing on Archer-Daniels-Midland Company. Credit Suisse Group, for instance, reestablished a “hold” rating and appointed a $46.00 price objective on shares of Archer-Daniels-Midland Company on April 7. There’s also Stifel Nicolaus who dropped their target price on the company from $46.00 to $45.00. The Missouri-based company also set a “hold” rating for Archer-Daniels on April 4. To simplify, two equities research experts have rated the stock as a “sell”, one has given a “strong buy” rating (that would be Zacks Investment Research) and seven have labeled it as a “hold”. Currently, ADM’s stock has an average “Hold” rating and their price target is $46.97.

On Wednesday, Archer-Daniels-Midland Company (NYSE:$ADM) opened at 42.02. ADM has a 12 month low of $39.01, a 12-month high of $47.88, a 50-day moving average of $42.74, and a 200 day moving average of $44.34. Last but not least, the Chicago-based firm has a market capitalization of $23.88 billion, a price to earnings ratio of 17.79 and a beta of 1.03.

ADM announced its quarterly earnings on May 2 and disclosed a $0.60 EPS for the quarter. This means that the firm missed their estimate of $0.61 by $0.01. It was reported that the firm had revenue of $14.99 billion for the quarter, while experts had predicted that ADM would bring in $15.15 billion in revenue. Many forecast that ADM will report $2.72 earnings per share for 2017.

It’s worth noting that Archer-Daniels-Midland Company recently announced a quarterly dividend, which was required to be paid on June 8. If you were a stockholder of record, you were paid a $0.32 dividend on May 18. This illustrates a $1.28 annualized dividend and a dividend earnings of 3.05%.

As of late, there have been a number of institutional investors who have decided to change their standings in Archer-Daniels-Midland stock. IndexIQ Advisors LLC, for instance, increased its position in shares by 67.3% in Q3. Respectively, IndexIQ Advisors LLC now owns 74,025 shares of Archer’s stock (valued at $3,122,000) after purchasing an extra 29,767 shares. Peoples Bank Oh also increased its stake by 0.5% in Q3. As a result, People’s Bank OH owns 4,750 shares (valued at $200,000) after purchasing an extra 25 shares in the last quarter. Last but not least, Zweig DiMenna Associates LLC bought a new share in Archer-Daniels-Midland Company during Q3 (valued at roughly $232,000). Presently, 72.82% of Archer’s stock is owned by hedge funds and institutional investors.

Featured Image: adm.com