Shares of Fossil Group (NASDAQ:$FOSL) are falling today after the Richardson, Texas-based company posted a sharp loss on Tuesday, and disclosed the departure of CFO Dennis Secor.

On Wednesday, in early trade, Fossil Group shares dropped 26%, after the steep sell-offs in the past two quarters, as business continued to fall apart.

In the report, Fossil Group reported that it swung to a Q2 loss of $344.7 million ($7.11 a share) from a profit of $6 million (12 cents a share) in 2016.

The watchmaker announced that global retail comps – which include e-commerce sales – dropped 11% year over year, with declines in the majority of product categories and regions.

In addition, Fossil Group handed Wall Street a weaker outlook. Now the company forecasts revenues to drop as much as 8.5% this year, which is up from a forecast of 6%. According to the company, these adjustments reflect “updated expectations of [its] 2017 wearables roll out.”

Even though the retail sector has taken quite the beating as of late, Fossil Group CEO Kosta Kartsotis said that the company is confident that new products will stimulate excitement in customers to shop its brand again.

“Wearables have the ability to help mitigate the ongoing softness in the traditional watch category,” Kartsotis said. “In our traditional watch business, we are managing through uncertainty…by focusing…on innovation.”

For Q2, Fossil Group said its wearables sales represented 9% of total revenue, which is compared with 7% in Q1. For its watches business, declines in conventional watches were partially counterbalanced by connected watches, Fossil Group said.

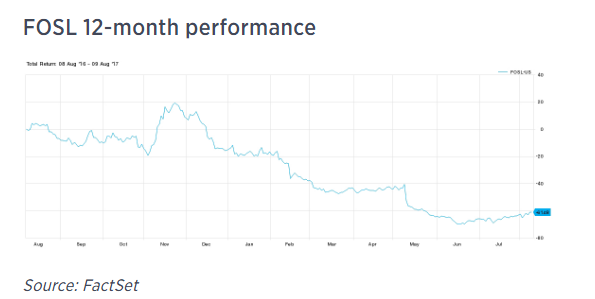

As of Tuesday’s close, Fossil Group shares had dropped 61% over the course of the past 12 months.

Featured Image: twitter