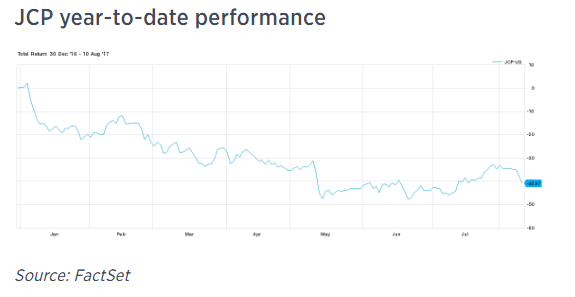

Friday is yet another busy day for the retail sector. Before the market opened this morning, J.C. Penney Company (NYSE:$JCP) posted a mixed second quarter report, causing its stock to free fall.

Due to the fact that earnings and same-store sales fell short of Wall Street estimates, the besieged retailer’s shares plummeted more than 16% shortly in early trading. In fact, at one point, the stock reached a low that had not been seen since at least 1972. The stock was last seen hovering around $3.94.

Even though J.C. Penney recognizes that the retail environment is full of challenges right now, it remains hopeful for the second half of 2017.

Here’s what J.C. Penney reported in the second quarter versus what Wall Street was forecasting:

- EPS: a loss of 9 cents, adjusted, compared to an expected loss of 5 cents, according to analysts polled by Thomson Reuters

- Revenue: $2.96 billion, compared to a Thomson Reuters estimate of $2.84 billion

- Same-Store Sales: a 1.3% decline, compared to a forecast decline of 1.2%

By now, most people are aware that department stores have been labelled as the laggards of retail today. And while Penney tries to paint a better portrait of its future, Wall Street is calling its bluff.

“While broader retail remains challenged, we are encouraged by the improved performance in our total apparel business, including a significant acceleration in kids’ apparel,” CEO Marvin Ellison said.

“Nearly all categories delivered improved sales results during the quarter, with our growth initiatives in beauty, home refresh and omnichannel continuing to deliver positive sales growth.”

However, for the second quarter, J.C. Penney still reported that their net loss widened to $62 million (20 cents per share), from $56 million (18 cents per share) in 2016. Not including one-time items, Penney’s lost 9 cents a share.

So what impacted earnings and gross margins in the second quarter? Many speculate that it was because Penney completed its closures of 138 stores and liquidation of inventory.

“We’ve never liquidated this many stores at one time, so it was difficult for us to forecast the margin impact in advance,” CEO Ellison said on Friday’s earnings conference call. “But we feel it was the right thing to do for our business. This decision will allow us to improve working capital, generate more cash flow and invest capital into more productive locations.”

Moving forward, and with the store liquidations in the past, Penney has echoed its outlook for the full year, except for one change to cost of goods sold.

For fiscal 2017, Penney expects comparable sales to fall within the range of negative to positive 1 percent, while adjusted earnings will come in at 40 to 65 cents per share.

On the upside, CEO Ellison said in-store order pick-up sends over 600,000 visits to Penney’s stores each week.

“The retailer who can most effectively combine physical stores, e-commerce and simplicity will be the winner,” Ellison said on Friday’s conference call.

Featured Image: twitter