Bitcoin’s Rise

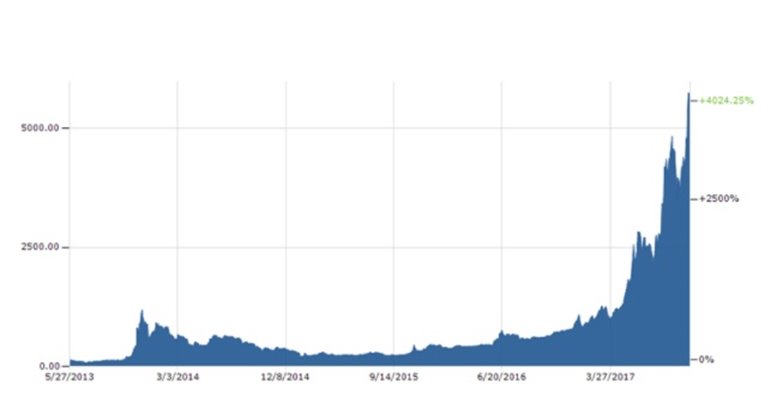

This week, bitcoin saw its price surge to a historical high of above $6,000, continuing a trend of setting record highs over the past year, which saw its value rise by 480%. But this is not stopping bitcoin ‘bulls’ from feeling ever more optimistic about the cryptocurrency. In fact, some are predicting that bitcoin’s price will soar to a five-digit figure and beyond.

Bitcoin’s Value To Reach $25,000 In Five Years

In a recent interview on Business Insider involving Tom Lee, FundStrat Global Advisor co-founder and accomplished Wall Street strategist, Mr. Lee maintains that he believes the value of bitcoin will reach $25,000 in five years despite the short-lived double-digit decline earlier this week.

According to Mr. Lee, bitcoin acts like a social network, meaning that the more engagement there is, the greater its value rises. In the short term, he thinks Bitcoin will reach at least $6,000 by mid-2018 (which has already happened).

He also argues that in the long term, bitcoin should be viewed as a store of value like gold was in the 1980s when some investors didn’t trust dollars.

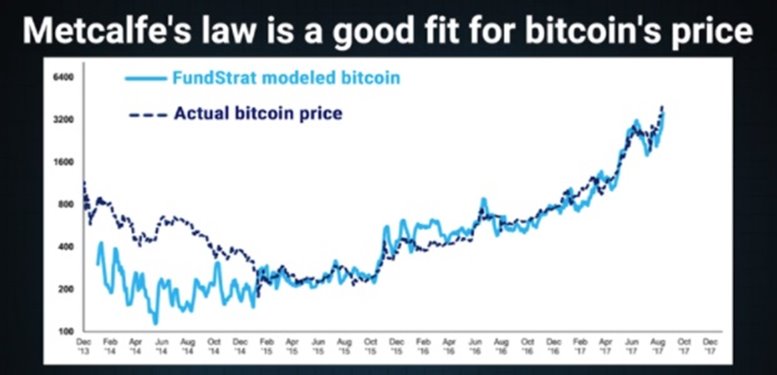

The theoretical basis of Mr. Lee’s claims is Metcalfe’s law, which essentially states that “the value of a telecommunications network is equal to the square of the number of connected users of the system.”

The valuation model based on this law used by Mr. Lee was able to explain 94% of bitcoin’s movement in the last four years (see graph below), so its accuracy cannot be understated. He also points out that Metcalfe’s law was really good at explaining the growth of the market values of tech giants like Facebook, Alibaba, and Google, proving that this model is reliable.

Bitcoin – The “Digital Gold”

As for bitcoin being a potential substitute for gold, Mr. Lee brings up that the future of businesses lies in the digital world, and bitcoin is a way of storing value digitally because it is basically data that is encrypted. Just like the way people have invested in gold in the past, investors of future generations will look to bitcoin as their store of value.

WIth this potential shift in investment attitude, Mr. Lee came up with a projected value of $25,000 in five years, under the assumption that investors will allocate 5% of their portfolio to alternative currencies and gold appreciates essentially at the same pace as nominal GDP.

In reality, the allocation is closer to 10% to 15% in some portfolios, so the $25,000 value is based on a rather conservative estimate. This five-year price projection could easily be $100,000 or even $200,000.

Other Reasons Why Bitcoin’s Value Will Rise

- Bitcoin As “Master Ledger”

Mr. Lee also mentions that since bitcoin is the most dominant token of all cryptocurrencies, investors will look to bitcoin as their “master ledger” as more and more other kinds of coins are rolled out, thus increasing its value even further.

- Interest From Big Investors Could Cause Liquidity Spike

An interest in bitcoin from big investors can also cause a liquidity spike since bitcoin is mostly held by miners and enthusiasts and not institutions, thus it has a low liquidity. As an example, Mr. Lee cites that oil prices went to $300 on a liquidity spike, and with that in mind, bitcoin reaching $75,000 is not out of the realm of possibility.

- Bitcoin’s Secure Encryption System

As a database, bitcoin’s encryption is incredibly difficult to crack. Its network is designed is designed in a way such that the bigger the database gets, the more secure it gets.

“So bitcoin is an encryption, but the encryption strength grows as there’s more miners. And today, it’s estimated that it would cost about $31B to create one fake coin.”

- Bitcoin Is Finite

Since bitcoin is only available in a finite number, as there will only ever be 21 million of them, this makes bitcoin a deflationary currency that becomes more and more valuable over time.

This is the opposite of regular currency, where the money supply can always increase, which makes the currency lose its value.

Bitcoin’s Volatility Is Nothing To Worry About

In response to concerns regarding bitcoin’s volatility, Mr. Lee compares the current patterns with gold, stating that “gold’s volatility for four years was about the same as bitcoin’s volatility today.”

China’s Ban Won’t Affect Bitcoin’s Value

In the past, Mr. Lee has been a strong advocate for bitcoin. Last month, he was adamant with his bullish position on bitcoin even after China’s ban on bitcoin exchanges, which caused the cryptocurrency market to crash.

He feels that China will not have any say in its forced selling aspect. A large number of people still consider bitcoin as a momentary bubble, and thus their perception will also have a big role in shaping the bitcoin market.

Mr. Lee was quoted saying:

“Well, for instance, you know number one Bitcoin is not what people think… We have some data, there’s only 300,000 holders of at least $5,000 so think about that that’s like saying the iPhone was a bubble in 2007 four days into the sale because there were 500,000 of iPhones. So it’s not that many holders of Bitcoin you know when you think about how many wallets there are today that holds $5,000, it’s huge so I think it’s still very early stages.”

Even then, there are rumors that China could reverse its decision, while other markets like Japan are already embracing the power of bitcoin as a means of exchange.

What’s Next For Bitcoin

So far, his prediction seems to be on the right track, as bitcoin’s price stormed back to $5,700 on Thursday, October 19. The outlook on bitcoin also leans toward bullish.

In terms of price, bitcoin has been trading above its 50-day moving average for the most of October, signaling that the upward trend will continue.

In addition, the Moving Average Convergence Divergence (MACD) indicator is approaching another high following this week’s movement, which also corresponds to the record highs in bitcoin’s value we saw during the week. This convergence of price and the MACD is an indication that the market trend for bitcoin is healthy.

The drop in bitcoin’s price earlier this week was likely a result of traders being indecisive with the cryptocurrency, as seen in the candlestick patterns. However, the eventual rebound in price shows that the buying pressure for bitcoin is incredibly strong, and it is reasonable to remain bullish as long as the price is above the $5,000 support.

The Bottom Line

All in all, bitcoin’s movement over the past month shows that it is on track to meet Mr. Lee’s prediction (it has already crossed the $6,000 mark much earlier than anticipated).

At this point, the $25,000 price target is probably just a price floor in five years’ time, and its value could even grow to six-digit figures by then. As evident from the tremendous growth rate we have seen this year, this is certainly a possibility.

Featured Image: fortune.com