For a while, it looked as if Energy Transfer Partners LP (NYSE:$ETP) was going to be making a comeback, but that optimism did not last long.

Along with the failed merger with Williams Companies Inc. (NYSE:$WMB), owners of the ETP stock now have to worry about the Philadelphia-based company shutting down its recently opened Dakota Access pipeline. Why? Because the United States Army Corps of Engineers are in the midst of reconsidering the potential impact of an oil spill.

After a drama filled year, Energy Transfer Partners investors can only ride out the roller coaster that is the ETP stock.

A Brief Overview: Energy Transfer Partners

Energy Transfer Partners has had their fair share of ups and downs over the past couple of years. Following a massive run-up through late 2014 in step with both gas and oil’s strong prices, ETP reached $52.47 in November of 2014. Essentially the goal of creating an underground pipeline from North Dakota to Illinois helped to blow on the flames of the rally that lead up to that high.

The project was overturned before it was even completed and turned on, however. Many speculated that the federal court would take the Standing Rock Sioux Tribe’s side on the matter, but they did not. Thankfully, then-President Obama did and he forced the work on the pipeline to a halt.

But, in President Trump’s first couple months in office, he put the project back into motion, which was completed in May and opened for business this month.

Now the project might be turned off again just as quickly as it was turned on. Judge James Boasberg stated:

“Although the Corps substantially complied with NEPA in many areas, the Court agrees that it did not adequately consider the impacts of an oil spill on fishing rights, hunting rights, or environmental justice, or the degree to which the pipeline’s effects are likely to be highly controversial.”

He added, “to remedy those violations, the Corps will have to reconsider those sections of its environmental analysis upon remanded by the court. Whether Dakota Access must cease pipeline operations during that remand presents a separate question of the appropriate remedy, which will be the subject of further briefing.”

It’s important to note that Judge James Boasberg’s ruling does not mean that the pipeline will be shut down. It could, but that decision won’t be made until a hearing takes place. As of right now, the date has yet to be determined.

Meanwhile, owners of the ETP stock are hanging their heads as they have been waiting for a break after a long couple of years. Since the highs seen in 2014, ETP stock is down more than 60%. This is less because of oil pullbacks and more because of the backlash associated with the Dakota Access pipeline. As a matter of fact, Energy Transfer Partners do not seem to be affected by weak oil prices.

ETP’s Stock is an Indication of Where the Company is Going

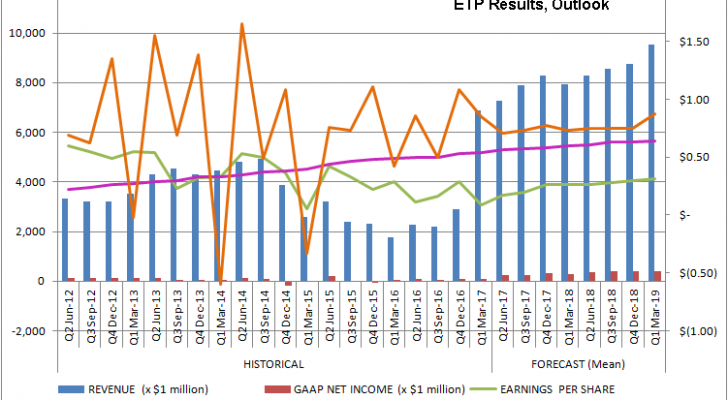

While weak oil prices crumble the demand for pipe-based delivery and the nationwide oil surplus means that there’s crude oil close for any prospective customer, Energy Transfer Partner’s revenue breakdown has not necessarily translated into a matching dip in earnings. More importantly, it has not crumbled the distribution of dividends that MLP owners adore.

So where does that leave investors? Well, seeing as the company’s results have not changed the minds of traders, the people that benefit the most will be those who pay attention to what the market is telling you about Energy Transfer Partners. To simplify, the shape of the chart of ETP stock holds the key.

If you look at the chart below, you will see that, thanks to June’s weakness, ETP is taking aim at a support level around $15.70. Furthermore, the shape of the chart is an upside-down cup-and-handle pattern. Say that the “brim” at $15.70 breaks, this could open the floodgates and send ETP’s stock lower.

Keep in mind that this is a matter of “if” not “when”. The stock could easily just kiss the floor and then shoot up and off of it. Many doubt that it’s just a coincidence that the floor could be tested around the time that the court hearing will decide whether or not the pipeline will be shut down.

Regardless of the company’s future, we can see that how investors feel about ETP stock is a lot different than how the company is doing.

The Takeaway:

Adding to the uncertainty of the future for ETP stock is that no matter what happens to the price, Energy Transfer Partners is almost guaranteed to pay a healthy dividend. As of right now, the yield is 11.1%. If Energy Transfer Partners shares fall to $15.70, that would ramp it up to 13.6%.

Should this happen, the outcome for traders will depend on what they consider to be important. For some, this would be more than enough income to not fret about any further downside in ETP stock’s price. For others, the uncertainty of the near term future is great enough to decide against this stock — at least until the issues surrounding the Dakota Access pipeline are resolved.

Featured Image: twitter