McDonald’s Corp (NYSE:MCD) has a long dividend growth history, making it a perfect stock for defensive investors. The dividend king Mcdonald’s Corp has increased its quarterly dividends in the last 41 consecutive years, thanks to its strong brand recognition and potential to generate sustainable growth in financial numbers. It currently offers a quarterly dividend of $1.01 per share, yielding at 2.54%.

McDonald’s has also been returning significant cash to investors in the form of share buybacks over the years. Indeed, it is among the biggest players in the S&P 500 index that are aggressively lowering their outstanding shares.

Dividend King McDonald’s Corp: Cash Returns are Likely to Increase

Besides past performance, the dividend king McDonald’s Corp appears to be in a stable position to expand its shareholders return in the following years. The company plans to return $24 billion to investors through dividends and share repurchases.

>> FANG Stocks Plunge in After-Hours Trade – Is It Netflix’s Fault?

To achieve its objective, McDonald’s is looking to generate mid-single-digit growth in sales and double-digit growth in earnings.

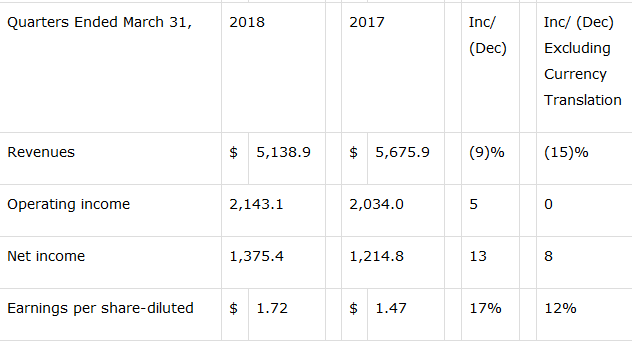

McDonald’s financial numbers are accelerating at an impressive pace year over year, and its cash flows are offering room for potential growth. The company has generated comparable positive sales in the past 11 quarters consecutively, and the guest count has increased in the past five successive quarters.

The Goldman Sachs team believes that sales enhancement at McDonald’s is likely to continue over the next few years. McDonald’s management claims that its strategy of keeping the customer at the center of everything permits them to generate robust growth in its top and bottom line.

The dividend king’s cash flow generation potential is strong enough to support its cash returns. The company has generated almost $1.1 billion in free cash flows in the latest quarter, whereas its dividend payments were only around $786 million. The massive gap in its free cash flows and dividend payments offers room for potential increase in its dividends.

Featured Image: twitter