eBay (NASDAQ:EBAY) shares plunged more than 9% early in Thursday trading after the company reported lower than expected results for its second quarter and reduced its outlook for the full year.

The shares of the online global commerce platform traded close to the 52-week range at present following disappointing performance for the second quarter. The eBay stock has been under pressure over the last year amid traders’ concerns over slow revenue growth. Its shares are up only 2% in the previous twelve months—with the 52-week trading range at $34 to $47 a share.

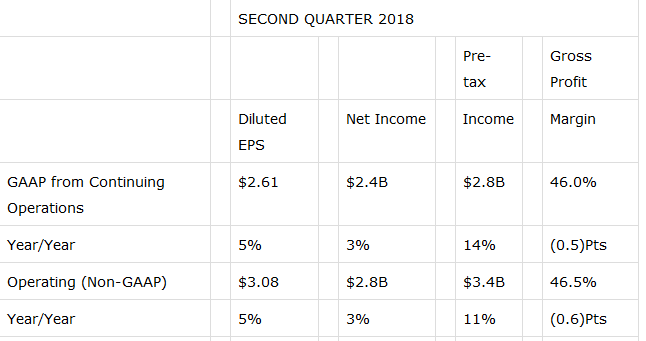

Second Quarter Results

Although eBay’s second-quarter revenue of $2.64 billion missed analysts’ estimates by $20 million, its Q2 revenue increased 9% since this time last year. The year-over-year revenue growth was driven by a 10% growth in gross merchandise volume (GMV). Its active buyers grew 4% across its platforms, increasing the total active buyer count to 175 million.

The specialty retailer has also been feeling pressure on its margins due to higher operating costs associated with its growth strategies. Its net income increased only 7% year-over-year in the second quarter on a revenue growth of 9%. The earnings per share, however, benefited from the significant decline in its outstanding shares; the company has reduced almost $1 billion of common stock during the second quarter.

Lower Outlook Negatively Impacted Traders’ Sentiments

eBay has reduced its outlook for the third quarter and the full year following weaker than expected results for the second quarter.

The company now expects its third-quarter net revenue to remain flat with the second quarter, while earnings per share will likely decline to $0.37 from $0.53 per share in the previous quarter.

The full year 2018 financial numbers are also likely to miss the consensus estimates. eBay anticipates a revenue between $10.75 billion and $10.85 billion compared to the consensus estimate for $10.95 billion. By and large, its share price is likely going to feel the pressure of the lower than expected outlook for this year.

>> Are Tesla’s Order Cancellations Out-Pacing Order Demand?

Featured Image: Twitter