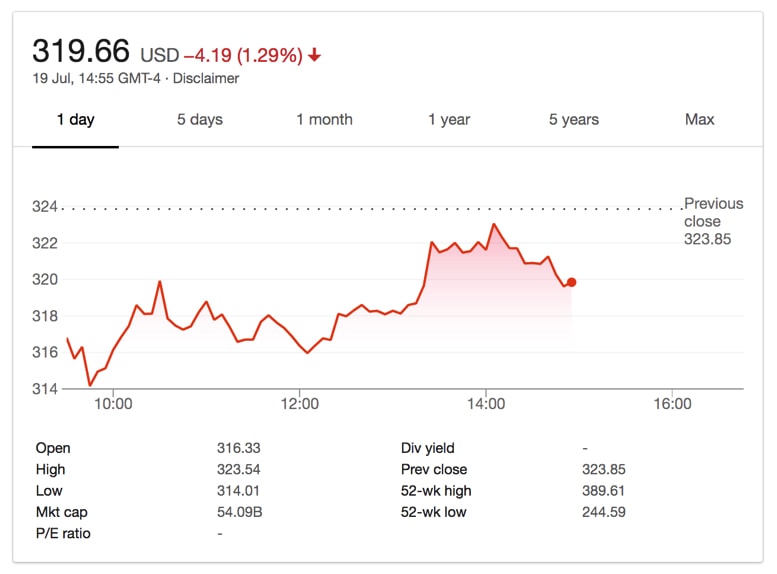

Tesla Order Cancellations: Tesla’s (NASDAQ:TSLA) stock fell nearly 3% yesterday.

A contributing factor could be that cancellations for Model 3 orders have increased in recent weeks. So much so that refunds are now outpacing deposits for the cars.

In fact, nearly 1 in every 4 orders are being canceled.

According to Needham & Co. analyst Rajvindra Gill, the rate of cancellations has doubled for the mass-marketed electric car.

Tesla Order Cancellations

Reasons for cancellation include extended wait times for the car, the expiration of a $7,500 tax credit, and the fact that Tesla has not yet made the $35,000 base model of the car available for purchase.

Luckily for customers, their $1,000 deposits to reserve a Model 3 are refundable. A further $2,500 is paid to choose a specific type of Model 3 but nothing else is paid until the car is delivered.

Gill’s report states that the wait time for a Model 3 is about 4 months to a year, and base model customers could wait until 2020.

Tesla Deny

Tesla is denying his findings, however. A Tesla spokesperson denied that Model 3 cancellations exceed new orders and suggest that Gill’s findings are outdated. The car company’s website currently lists wait time as 1-9 months.

Is this just a spat between a disgruntled analyst and a proud car-company though?

But again Gill is skeptical, doubting that Tesla will hit that target by the end of the year as planned.

>>Aston Martin Releases Volante Vision Concept

Tesla and it’s CEO Elon Musk have always been accused of “burning through cash” with the company still slow to make a profit since it’s inception 8 years ago. Reflecting on this, Gill expects Tesla to burn through a further $6 billion by 2020 and considers the stock to still be overvalued despite its 16% fall since June 2017’s peak.

Tesla Stock Price

Currently, Tesla’s stock sits at $319.70 a drop of $4.20.

Featured Image: Deposit Photos/Arcady