For those looking to make an investment that has high potential and few investors considering it, you might want to think about energy investing. More specifically, investors might want to consider the long-term forecast for companies such as Transocean, SunPower, and Parsley Energy.

In 2016, there was a lot of talk surrounding energy investing as oil prices were starting to rise and many believed that this was a sign that the oil market was back in the running. However, in 2017, few remain with this mindset. This is because oil prices have sat in the $50-a-barrel range for a considerable amount of time, while alternative energy investments, such as wind and solar power, are in the middle of their own deterioration.

As a result, Wall Street has developed a pessimistic mentality when it comes to energy stocks. This means that the time has come for long-term investors to start putting money in this sector of the market.

Keep reading for a brief overview on the top three stocks that investors should consider for their 2017 energy investments.

1. Transocean (NYSE:$RIG)

Transocean is an offshore driller and based on the estimate at which Transocean’s stocks trade, Wall Street seems to have left this industry behind. Shale drillers have been able to increase their production at a rapid rate, which means that they have more or less cancelled out the production declines from OPEC. This rapid output has kept the the oil market from using its high levels of inventory. As a result, oil prices have maintained considerably low prices, and there are only a select few who are willing to contract rigs for offshore work.

That said, if you are proactive investor, buying shares of Transocean could provide you with quite the opportunity.

Even though shale producers have done a tremendous job of growing production, they won’t be able to permanently counteract the gains in demand and declines from legacy fields. When these declines start to affect total global output, prices will rise, and this will increase the lure to spend on non-shale sources, like offshores. Essentially when this happens, Transocean will have a lineup of high-specification rigs which will be ready to meet that increased demand.

Keep in mind that Transocean is in better shape financially in comparison to other offshore drillers. As a result, Transocean has the best odds of escaping this decline, which leads many to think that this will deliver promising results to shareholders when the market gets back on it’s feet.

Additionally, it’s important to note that Transocean has a tangible book ratio of 0.22, which means that their shares are selling for very little money.

2. Parsley Energy (NYSE:$PE)

As an independent oil and gas producer, Parsley Energy decided to go public in the middle of 2014, which was right before oil prices plummeted. As a result of Parsley’s exquisite timing, the company was able to raise a basketful of cash with their Initial Public Offering, which allowed them the capital needed to do well during the oil market decline. As a matter of fact, since its IPO, Parsley has gone on to increase output at a 16% compound quarterly rate.

One of the main reasons that Parsley Energy has seen such an increase is due to their position in the Permian Basin. Parsley has taken advantage of the decline by making deals, which in turn has led to the expansion of the Permian Basin. These transactions have led Parsley to become the second-largest acreage holder in the Midland Basin portion of the Permian, trailing only behind Pioneer Natural Resources (NYSE:$PXD). This is worth noting because Bryan Sheffield, Parsley Energy’s CEO, is the son of Pioneers retired CEO, Scott Sheffield. Scott Sheffield used Pioneer’s Permian acreage as the catalyst to create value for investors. Over the past decade, this stock is up by more than 200%.

Aside from it’s standing in the Permian Basin, Pioneer’s success comes from their avoidance of using debt to finance growth. Rather than that, Pioneer has relied heavily on the compliance of asset sales as well as equity issuances to finance drilling. This is a strategy that Parsley has followed for the past couple years, and it has not only led them to deliver rapid output growth, but it has created value for investors who bought at its Initial Public Offering. Since it first went public, the stock is now up by more than 40%. In the meantime, thanks to hundreds of high-return drilling locations and an immaculate balance sheet, Parsley Energy has the means to keep growing at a healthy rate.

3. SunPower Corp.

Unfortunately, the solar power industry is going through a bit of a rough patch as of late. The industry’s downturn has resulted in an ugly year for Sun Power, which is a promising solar panel manufacturer. All of this factors into why the global market is oversupplied with manufacturing capacity, and this capacity has put pressure on prices as solar panel manufacturers are fighting for business.

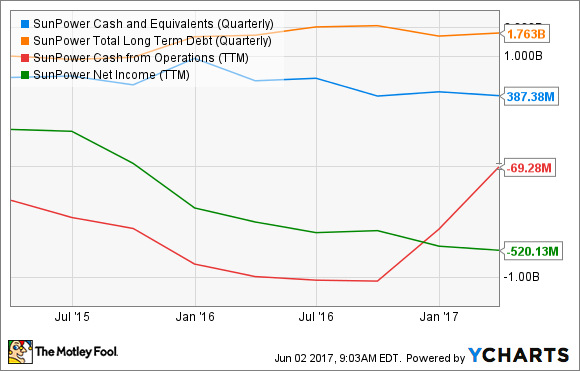

When you factor in the improvements that others have made in regards to panel costs, you will see that SunPower’s offerings have lost a bit of their competitive advantage. The past couple years have proven to be tough on SunPower as they have had massive losses, consumed a considerable amount of cash, and obtained more debt.

Additionally, SunPower has a weak balance sheet which means there is a considerable amount of risk that this company will have to endure until the solar markets gets back on its feet. Plus, there’s risk that their method of adapting to the new competitive landscape won’t work out.

That said, even when taking into consideration the above mentioned risks, now might be the time to think about opening up a position in SunPower Corp. If you’re looking to make energy investments, don’t dismiss SunPower just yet. Take a look at their history of modernization, their strong backer in shareholder Total, and finally, the fact that this company should be in position to thrive when the energy market recovers.

Featured Image: twitter