There are a number of companies who are starting to invest a considerable amount of money into lithium-ion battery manufacturing institutions. In 2016, the top 13 battery makers had an annual production capacity of 29 gigawatt-hours (GWh) of energy-storage products. In fact, these same companies are predicted to grow output capacity to 171 GWh by 2020. Tesla’s Gigafactory will represent 35 GWh all by itself.

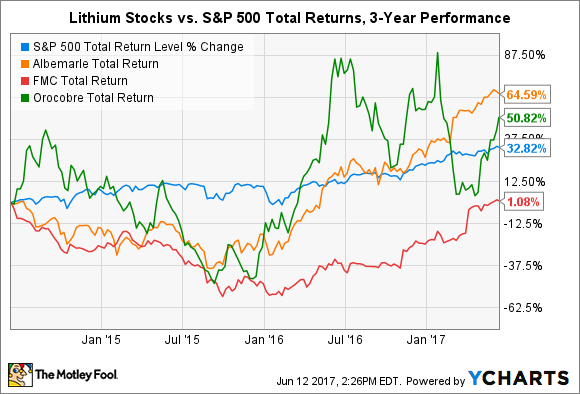

It’s worth noting that while there are enough lithium reserves in the world to meet long-term demand, there are still concerns about whether supply can increase fast enough in the near term. That said, don’t fret if you were thinking about investing in lithium as the top lithium producing companies are ready to take on the challenge. But wait, it gets better! Even if these companies fail, the mix of increased selling volumes and higher prices will mean that business will flourish no matter the circumstances for companies such as Albemarle (NYSE:$ALB), FMC Corp. (NYSE:$FMC), and Orocobre Limited (NASDAQOTH:$OROCF).

An increase in demand leads to an increase in supply

As of right now, the top two lithium products are as followed: lithium carbonate and lithium hydroxide. Both products, which have seen an increase in demand and prices, have increased income, revenue, and shares for the top lithium producers. Wall Street admires any company, whether it’s Albemarle or Orocobre, that reports results from the lithium segment.

With that said, the actual results have played a defining role as well. Albemarle, for example, announced that they had a 31% year-over-year revenue growth in their lithium and advanced materials sector in Q1 of 2017, whereas adjusted EBITDA increased 38% in the same time frame. At the same time, FMC Corp.’s lithium division reported revenue and operating income growth of 9% and 45%. Keep in mind that FMC obtains most of its business from developing agricultural products, but lithium is on rise and has pledged to power an enormous amount of growth potential.

If you were to look at SEC filings or any other regulatory documents, you will see that the success of lithium stocks may not be ending for a while. Albemarle, for instance, just reported the approval to extend lithium concentrate output at its Greenbushes, Australia, mine in a 50/50 joint deal. Keep in mind that this extension will not start until Q2 of 2019 but it will double lithium carbonate output capacity.

That said, Albemarle is not going to wait until 2019 to further its capacity. It is expected that capital payments in 2017 are going to range from $350 million to $400 million. If, for example, the amount of money dedicated to operations reaches the top end of its range of 4% to 6%, investors can then infer that the specialty-chemical company is investing somewhere between $190 million to $240 million in both growth and expansion projects (most of this money will be for the lithium sector).

Meanwhile, FMC Corp., a chemical manufacturing company, has started to heavily invest so they can expand their lithium projects. In May of last year, the Pennsylvania-based company reported that they would be working to triple lithium hydroxide output capacity by 2019. The first phase of FMC’s project will commence in mid-2017. Additionally, FMC Corp. management has announced that their long-term plan is to spin-off the lithium division as a separate publicly owned company.

The majority of producers in the lithium industry have promised to either double or triple lithium output and the country of Argentina is no stranger to this pledge. Orocobre Limited has a number of operations in Argentina and the South American country is the third largest lithium producer in the world. Not only that but Argentina has a number of reserves right in the middle of the Lithium Triangle.

It’s a race against time for companies looking to purchase and develop land in Olaroz and Cauchari. As we speak, Orocobre is working on doubling output and processing capacity by 2018 within their joint deal with Toyota Tsusho Corporation.

Upon completion, processing institutions in Olaroz will be eligible to accommodate the very first commercially operable projects in the Cauchari deposit. This will include projects by Lithium America’s and Ganfeng Lithium, Albemarle, and Canada’s Advantage Lithium.

How will this affect investors?

If there is going to be an increase in lithium-ion battery manufacturing institutions in the next few years, there needs to be an increase in lithium supply from a variety of producers. As mentioned, investors looking to make lithium investments don’t need to worry as the top lithium companies are up for the challenge. All in all, if you’re looking to start investing in lithium, you might want to add Albemarle, FMC Corp., and Orocobre to your investment portfolio.

Featured Image: orocobre.com