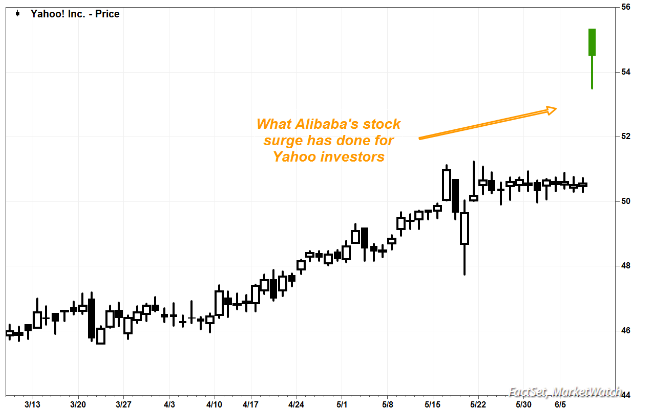

Even though Yahoo Inc. delayed spinning off its massive share in Chinese e-commerce company Alibaba Group Holding Ltd. (NYSE:$BABA), Yahoo investors may be a little more open to forgiveness after they hear that Alibaba’s positive revenue outlook helped to send Yahoo’s stock to a 17-year high and pushed its coffers by $6 billion.

According to Maggie Wu, Chief Financial Officer for Alibaba, the fiscal 2018 revenue is predicted to increase 45% to 49% above 2016 levels. This caused excitement in the crowd at the company’s Investor Day in Hangzhou, China. According to a FactSet survey of Wall Street analysts, this was above the expectations of 36% growth as of May 31 and it compares with 47% growth in 2017.

This sent Alibaba’s American Depositary Receipts (ADRs) climbing $16.70 (13.3%) towards a record close of $142.34, which added roughly $43.1 billion to Alibaba’s market capitalization. This is now known as the biggest one-day price and percentage gains since ADR made their first public appearance on the New York Stock Exchange on September 19, 2014.

At the same time, Yahoo Inc.’s stock increased $5.16 (10.2%) to $55.71, which is the highest close since September 22, 2000.

In 2016, Yahoo Inc. (NASDAQ:$YHOO) agreed to sell its web assets to telecommunications company, Verizon Communications Inc. (NYSE:$VZ). This deal has left investors in limbo for a number of years as it tries to find a way to convert its Alibaba holdings. That said, investors expect this deal to close next week.

According to the most recent filings, as of March 31, Yahoo still had ownership of 384 million ordinary shares of Alibaba. These shares were based on ADR prices which valued that share at $41.41 billion at the time.

Seeing as 1 ADR represents 1 ordinary share, the rally in Alibaba’s ADRs that occurred on Thursday should increase the value of Yahoo’s share by $6.41 billion. Additionally, since Yahoo first said it was postponing their plan to spin off the share in 2015, the value of the share has expanded by $22.26 billion, thus comparing to Yahoo’s current market capitalization of $52.38 billion.

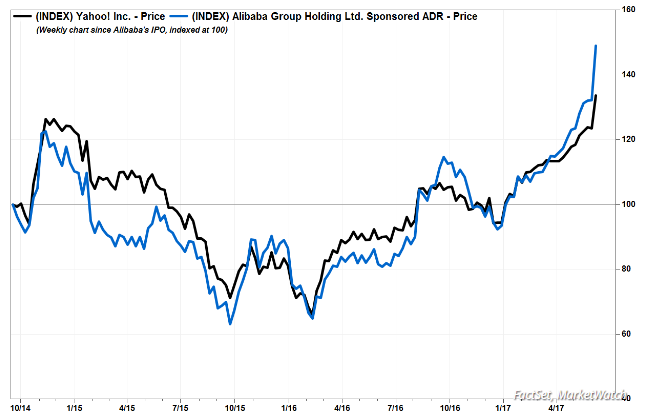

Currently, Alibaba’s ADRs are worth more than double the IPO price of $68. These ADRs have soared $62.1 year to date. At the same time, Yahoo shares have assembled 44.1% and shares of Amazon.com Inc (NASDAQ:$AMZN) have increased 34.7%. In addition, the S&P 500 index ($SPX) has seen a 8.7% increase so far in 2017.

After Alibaba’s IPO, the correlation coefficient between Yahoo’s stock and Alibaba’s ADRs has been 0.896. This makes 1.000 a perfect match.

Yahoo individually stated on Thursday that its shareholders have given their blessing for the deal with Verizon and it is now expected that the deal will come to a close on June 13, 2017. Meanwhile, Yahoo will be changing its name to Altaba Inc. According to the Wall Street Journal, Verizon will downsize 2,100 jobs at Yahoo and AOL following the completion of the Yahoo deal.

In addition, Yahoo also stated that they will be expanding their offer to purchase up to $3 billion of its common stock from June 13 at 11:59 p.m eastern time to June 16 at 11:59 p.m.

Featured Image: twitter/Getty Images