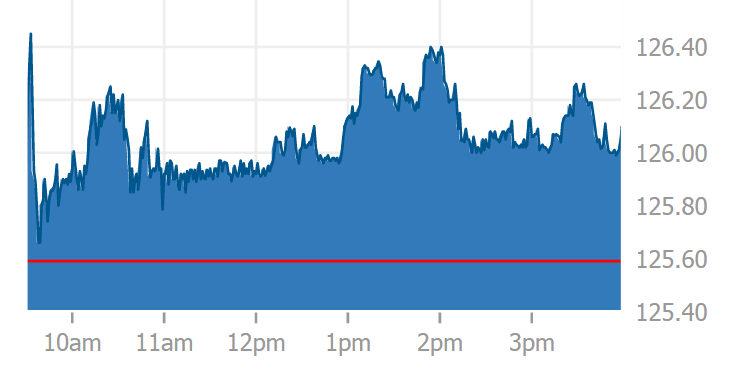

Are you looking to get into financial investing? If so, you should know that CME Group Inc (NASDAQ:$CME) was apart of the action that took place on the stock market on June 13, where they traded on remarkably high volume. The Chicago-based company’s stock increased 0.38% to close at $126.07. On Tuesday, CME witnessed 2.22 million shares trade hands on nearly 19,681 trades. Seeing as the CME Group Inc.’s stock averaged a daily volume of 1.42 million shares a day in May, this clearly indicates a bump in volume.

Typically, when a stock experiences a sudden and rapid increase in trading volume, it could be seen as a bullish sign for investors. If a company experiences a spike in trading volume, this suggests that there needs to be more market awareness. Essentially this means that the company needs to set up more of a meaningful move in stock price. Additionally, added volume allows for a level of support and stability for price advancement.

Over the past 52 weeks, CME’s stock has traded somewhere between $127.60 and $92.29. As of right now, CME’s 50-day SMA is $117.30 while it’s 200-day SMA sits at $112.66. The financial company has a price-to-book ratio of 2.08 and a price-to-earnings ratio of 26.9.

It should not come as a surprise to hear that CME Group Inc. is the world’s leading marketplace as they have futures exchanges and clearing houses which help to deal with risk management and the investment needs of clients. CME offers the following: futures and options, foreign exchange, energy, agricultural commodities, weather derivatives, and real estate.

As mentioned, CME Group Inc. is headquartered in Chicago, and as of right now, the company has 2.700 employees and works under CEO Terrence A. Duffy.

Featured Image: twitter