General Electric (NYSE:GE) share price regained momentum in the last couple of trading sessions, driven by its strategy of selling $20 billion worth of assets. The management plans to pull the company out of its $140 billion debt burden through asset sales; they believe the General Electric debt reduction strategy would also help in enhancing its liquidity position and credit ratings.

After less than one year of the merger with Baker Hughes (NYSE:BHGE), General Electric confirmed the plan to sell 62.5% of its stake in oilfield services company.

Traders applauded its strategy of simplifying GE’s business model and focusing more towards industrial and electric businesses. General Electric’s management is looking to retain GE’s power, aviation, and renewable-energy divisions.

General Electric Debt Reduction Strategy: Dividend Cut is Coming

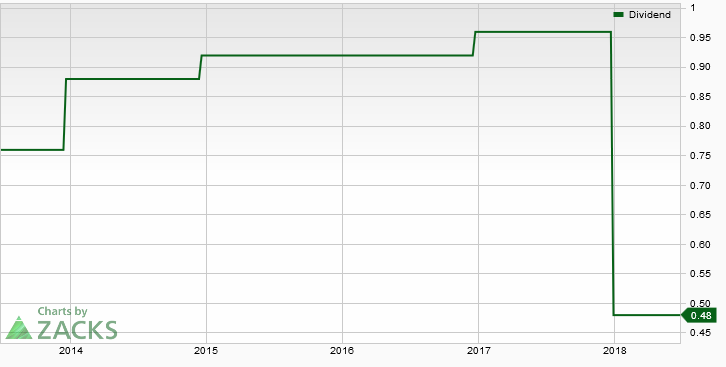

The quarterly dividend was slashed by 50% at the beginning of the year to support the General Electric debt reduction strategy. The company, however, isn’t in a position to cover the current dividend payments through its internal cash generation; it announced to make another cut in quarterly dividends along with the spinoff of its healthcare business.

CEO John Flannery confirmed the dividend cut, saying, “the healthcare spinoff will likely lead to a reduction in the GE dividend.“

Goldman Sachs, on the other hand, suggested that GE management suspend dividends for the next 12 to 18 months instead of making a dividend cut. It believes dividend suspension could help GE save $6 billion over the next 18 months – which they could use for debt reduction.

>> Schlumberger Limited: Future Fundamentals Are Stable

Restructuring Strategies Could Help in Building Trader’s Confidence

General Electric shares have lost almost 50% of value in the last twelve months in addition to downgrades from credit rating agencies. Nevertheless, trader’s confidence improved since it began its strategy of selling non-core businesses and moving the focus towards industrial business – which could help it generate a sustainable growth over the long-term. The debt reduction target of $25 billion and cost-saving of $500 million by 2020 would also enhance its liquidity position.

Featured Image: Twitter