General Mills’ (NYSE:GIS) future fundamentals and tumbling financial numbers indicate moderate dividend growth in the days to come.

Although General Mills has raised its quarterly dividends thirteen times in the last ten years, its dividend growth rate declined sharply in the previous two years, and its future fundamentals indicate modest dividend growth in the days to come.

Why Is General Mills’ Dividend Growth Slowing Down?

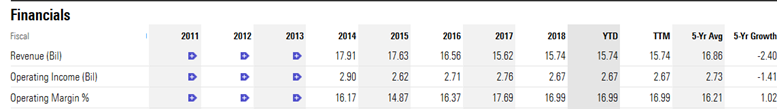

The company has been experiencing declining demand for its consumer products as private labels emerge and fierce competition increase. Its sales plunged from $17 billion in 2013 to $15.74 billion last year, representing a decline of more than 2% in the previous five years.

Negative revenue growth, along with higher marketing expenses, has also been putting pressure on its earnings potential. Its operating profits declined on an average of 1.4% in the previous five years. Indeed, the downtrend in its earnings accelerated in the last couple of quarters.

The company’s operating profit of $561 million in the latest quarter plunged 8% since last year – as impairment, higher restructuring, and other exit costs are negatively impacting its margins.

Its dividend payout ratio based on income, on the other hand, jumped sharply in the past two years. The company offers a quarterly dividend of $0.49 per share at present, whereas its earnings per share stood around $0.59 per share in the latest quarter. This means that GIS is returning more than 80% of its earning to investors in the form of dividends – which offers less room for potential dividend growth.

>> Broadcom Announced CA Technologies Acquisition – Analysts Downgraded Stock

General Mills Introduced New Business Strategies to Counter Headwinds

The company has announced a new business strategy to support its top and bottom line performance. Its business strategy is based on three key factors:

- Competing across all geographies, through marketing, innovation and in-store execution

- Accelerating differential growth platforms, including Häagen-Dazs, Snack Bars, Old El Paso, and the Natural & Organic portfolio of brands

- Reshaping the portfolio for growth through acquisitions and divestitures

Though General Mills’ business strategy looks attractive, its dividend growth is likely to remain under pressure in the short-term. The company needs more time to rebuild its portfolio in order to generate a sustainable increase in revenues and earnings.

Featured Image: twitter