On July 25, Eli Lilly & Company (NYSE:$LLY) reported a Q2 net profit that increased to $1.01 billion (95 cents a share) from $747.7 million (71 cents a share), in the same time frame in 2016. It’s fair to say that these results shattered profit and sales expectations.

So how exactly did Eli Lilly beat profit and sales expectations? Well, let’s consider the numbers:

Excluding non-recurring items, Eli Lilly’s adjusted earnings per share was $1.11, beating out the FactSet consensus of $1.05. Revenue increased 8% to $5.82 billion, above the FactSet consensus of $5.59 billion, as strong growth in new pharmaceuticals products helped to counterbalance weakness in animal health. For the current year, Eli Lilly predicts adjusted EPS of $4.10 to $4.20, while the revenue outlook was boosted to $22.0 billion to $22.5 billion from $21.8 billion to $22.3 billion.

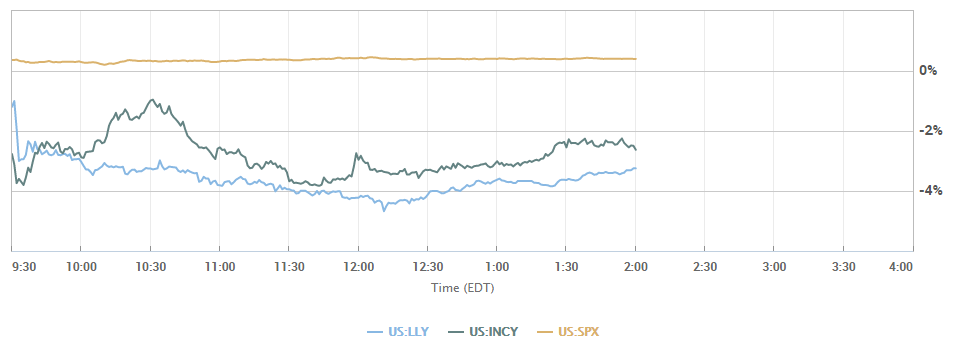

Independently, Lilly and Incyte Corp announced that a resubmission for the new drug application for a treatment of rheumatoid arthritis will be postponed beyond 2017, as the FDA has suggested that a new clinical study is necessary.

Lilly’s stock was indicated marginally lower in pre-market trade, and Incyte’s stock fell 2.6%. So far this year, Lilly shares have rallied 15% and the S&P 500 has gained 10.3%.

Featured Image: lilly