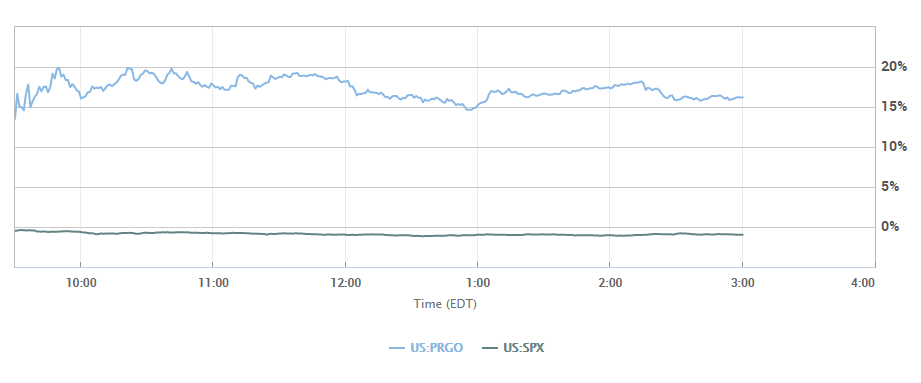

If you’re looking for a drug manufacturer to invest in, you should know that Perrigo Company plc (NYSE:$PRGO) saw its shares increase 12.2% in pre-market trade today. Why? It all started after the company posted Q2 profit and revenue beats and hiked up its 2017 full-year guidance.

Let’s dive into the numbers!

Perrigo reported a loss of $69.9 million (49 cents per share), narrowing a loss of $534.3 million (loss of $3.73 per share) in the 2016 period. Adjusted EPS came in at $1.22, compared to the FactSet consensus of 92 cents. Additionally, revenue increased to $1.238 billion from $1.341 billion, compared to the FactSet consensus of $1.175 billion.

With the changes made to the 2017 guidance, Perrigo now forecasts full-year earnings per share to be between the range of 84 cents and $1.09, compared with the FactSet estimate of $1.58, and adjusted 2017 earnings per share between the range of $4.45 and $4.70, which is above the FactSet consensus of $4.28.

Even though there have been other generic drug manufacturer companies struggling with pricing challenges, Perrigo’s consumer business “essentially front-of-the-house [over-the-counter] products in private-label (US) and branded (ex-US) presentations showed particular strength this quarter, driven by private-label launches in the U.S. and strong performance in Mexico,” Dewey Steadman of Canaccord Genuity said.

While it’s true that Perrigo’s generics business did report a 13% year-over-year revenue decline, they have been launching new products and the business unit has the potential to “quickly become non-core to Perrigo under new leadership,” which, according to Steadman, is expected soon.

Over the course of the last three months, shares of Perrigo have dropped 11%.

All in all, if you’ve been on the hunt for a drug manufacturer, Perrigo Company plc is definitely not one to skip over.

Featured Image: depositphotos/londondeposit