General Electric (NYSE:$GE) might have beaten earnings estimates, but the company’s quarter two results showed a tremendous amount of weakness. The shares are reaching new 52-week lows, and, despite a relatively low valuation, there is a chance that this would only be of interest to income investors.

The Boston-based company’s quarter two results indicate that the company performed better than expected, on both the top line and when it comes to the earnings per share number. However, this double beat was not enough to persuade investors to buy up shares of the company. And as we will soon see, GE’s quarter two results showed a lot of weaknesses.

First and foremost, General Electric’s quarter two beat was a direct result of heavy adjustments to the company’s GAAP results:

When looking at GE’s net earnings per share without any adjustments, we can clearly see that it was just $0.13 – this is less than half of General Electric’s non-GAAP results. Even though it was expected due to M&A activities, revenues were lower, which caused the company’s margins to get hit pretty hard.

In addition, General Electric’s industrial margin dropped 760 base points to just 8.5%. What caused this plunging margin? It is thought to be because of the GE’s oil and gas business, in which margins fell from 9.9% to 5.0%

Seeing as oil and natural gas prices have been down in 2017, it shouldn’t come as a total surprise that oil and gas manufacturing companies are attempting to limit their costs wherever possible. Why does that affect General Electric? Well, because General Electric has gas and oil divisions, they are getting pressured to reduce their pricing, which results in battered margins. Basically, so long as gas and oil companies are unable to produce at healthy profits, companies like GE will continue to be faced with pressure.

Not surprisingly, CEO Jeff Immelt has also disclosed that General Electric will only deliver earnings per share at the bottom of the predicted range (around $1.60).

It doesn’t stop there, however. There were other negatives in the quarter two results as well.

For starters, General Electric’s cash flows remain under pressure, cash from operating activities fell by nearly 70% year over year (for H1). In the first two quarters, the cash dividend from GE Capital totaled $4.0 billion, and without that GE would not have been able to showcase any positive cash flows.

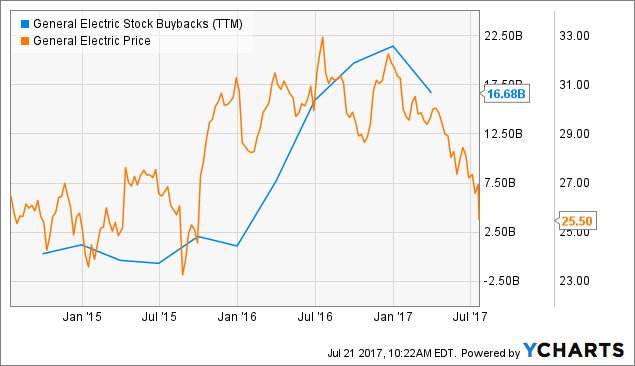

If you guessed that this is a major negative for the company, you’re right. It means that stock buybacks and dividends are not financed through the proceeds GE generates through its operations, and they are instead financed out of the company’s substance. It is the same for General Electric’s capital expenditures, which are essential for an industrial company that has to constantly upgrade and expand its production facilities.

According to General Electric’s management, cash flows are likely to improve in the second half of 2017, but unless there is a massive jump in the company’s cash generation General Electric will once again have weakened its balance sheet. Throughout the first six months, GE has returned $7.8 billion to its owners through buybacks and dividends, so it is hard to believe that the company’s H2 cash flows will make up for that amount in addition to all of the cash that GE will pay out over the course of the next six months.

Looking at GE’s buybacks, one can see that the timing has not been great. For instance, the highest amount was spent during a time when the company’s share price was the highest, whereas buybacks were lower during times when GE’s share price was lower. It would have been more beneficial to do the opposite, as each dollar spent on buybacks while shares prices are low has a bigger impact than the dollars spent on buybacks when GE’s share price was 30% higher than it is at this moment in time.

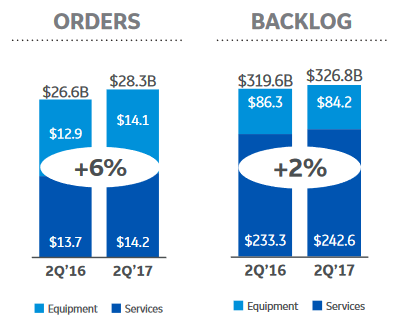

With all that being said, it is important to note that not everything was bad in the last quarter:

General Electric ended up growing its orders and its backlog, which, generally speaking, is a good position to be in. Higher orders allows for a higher revenue run rate, and this would likely result in improved margins. At the same time, a growing backlog suggests that GE is in a better position during hard times for the global economy. Why? Because it is less reliant on a constant order inflow.

The issues seen during Q2 were not related to the attractiveness of the company’s products and offerings, as the increase in orders suggests that customers are willing to purchase from the company. The problem centers around General Electric’s execution.

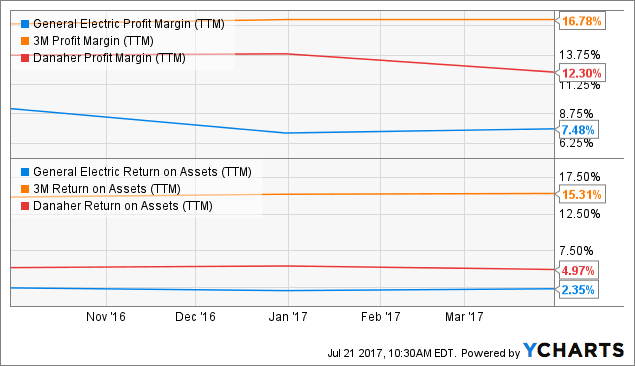

As long as General Electric drops behind other big industrials in regards to margins and capital efficiency, the Boston-based company will continue to trade at a lower valuation, thus meaning that capital appreciation will remain limited.

The Investor Takeaway:

As mentioned, General Electric’s quarter two results indicated a lot of weaknesses: low margins, low capital efficiency, low cash generation, and much more. All together, despite some positives and a low valuation, GE shares don’t have a whole lot of upside over the near future. That is, of course, until the company’s new management can right the ship.

If you’re an income seeker, the dividend yield (3.8%) is quite attractive, because one can obtain twice as much from GE than from the broad market right now.

Featured Image: Depositphotos/© jetcityimage2