For those looking for the best long term dividend stocks to invest in, check out the 2017 Dividend Aristocrats list. The list consists of 51 companies with stocks in the S&P 500 Index. To become a Dividend Aristocrat, these companies will have to: A) be in the S&P 500 Index, B) have at least 25 consecutive years of dividend increases, and C) meet certain liquidity and size requirements.

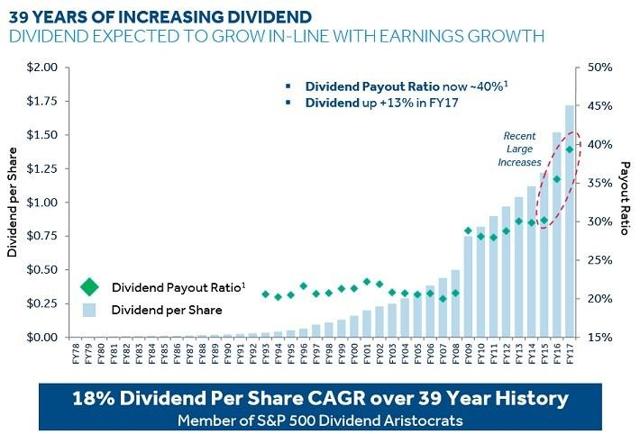

While there are currently 51 Dividend Aristocrats, investors might want to think about adding Medtronic (NYSE:$MDT) to their ‘watch-list’. Founded in 1949, Medtronic is one of the largest healthcare companies in the world. Operating in more than 155 countries around the globe, Medtronic has increased its dividend for 39 straight years. To top it off, Medtronic increased its dividend by an average rate of roughly 20% every year over those 39 years. As one can imagine, this makes Medtronic one of the best long term stocks to buy.

Furthermore, the company has paid four unchanged quarterly dividends in a row. Since Medtronic tends to announce its annual dividend increase during the last week of June, investor’s should be on the lookout for yet another increase.

In this article, we will discuss Medtronic’s impressive business model and their growth forecasts, as well as how the company is going about raising its dividend for 2017.

Medtronic’s Business Model

Medtronic is a medical technology and services company. Currently, it operates four sectors: cardiac and vascular, diabetes, restorative therapies, and minimally invasive therapies. Altogether, Medtronic’s healthcare products are able to treat almost 40 different medical conditions.

One of the great aspects of Medtronic is that the company has experience in both business focus and geographic markets.

Out of the four sectors, Medtronic’s largest is the Cardiac and Vascular Group. Within this segment, the group has 3 product categories, which are Coronary & Structural Heart, Cardiac Rhythm & Heart Failure, and Aortic & Peripheral Vascular.

Due to Medtronic’s global leadership across its diverse product categories, the company bears witness to a steady incline of growth. In fiscal 2016, for instance, Medtronic’s adjusted earnings-per-share grew by 2%.

Fiscal 2017 just wrapped up and Medtronic’s results were even better than the year prior. Organic revenue grew by 5% in the fiscal Q4 as well as the full fiscal year. Furthermore, as a result of cost cuts and revenue growth, Medtronic’s diluted earnings-per-share increased 17% for 2017. Medtronic also saw their adjusted earnings-per-share, minus currency fluctuations, grow by 11% to $4.60.

Impressively, all four operating sectors produced growth in fiscal 2017, with organic growth in the Minimally Invasive Therapies Group leading the back by 4%.

Growth Forecast

In order for Medtronic to continue moving forward, the Dublin-based company will have to focus on its product pipeline, acquisitions, and growth in emerging geographic markets.

First and foremost, Medtronic has been heavily investing in its product pipeline. As a result, the company is able to enjoy a strong product lineup which will produce future growth.

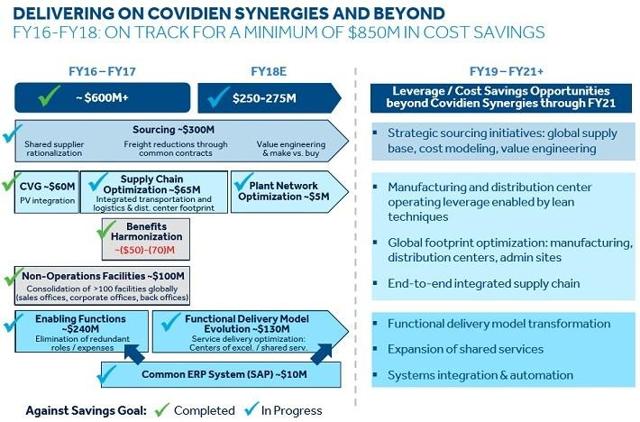

Second, Medtronic is expected to grow through acquisitions. Over the past several years, the biggest acquisition for the company was the $43 billion takeover of Covidien in 2015. In this acquisition, Medtronic has been able to produce considerable cost savings, thanks to overlapping operations across several different functions. These functions include manufacturing, suppliers, and distribution.

Within fiscal 2017, Medtronic realized synergies of $600 million. Additionally, synergies are forecasted to total another $250 million to $275 million this year. This would bring the total to more than $850 million in two years. Medtronic has predicted that synergy benefits will continue through fiscal 2021.

Last but not least, Medtronic will continue to grow by focusing on emerging markets. Dating back several years, the company has raised its new market revenue by 10% each year. In fact, Medtronic has a presence in a number of attractive markets, including China, which represents 40% of the company’s new market revenue.

In fiscal 2016, the new markets outperformed Medtronic’s other geographic sectors. Emerging market revenue grew 9%, while U.S. revenue increased 1% for 2016. Now, the emerging markets account for $4 billion of revenue for Medtronic, which represents 14% of total sales.

With the help of the above-mentioned growth catalysts, Medtronic predicts fiscal 2018 to be yet another year of growth and opportunity. Medtronic has disclosed that in fiscal 2018, constant-currency revenue growth is expected to be around 4%-5%. Additionally, according to Medtronic, adjusted earnings-per-share growth should be around 9% to 10% in fiscal 2017.

Medtronic’s Competitive Edge & Recession Performance

Medtronic has a number of competitive advantages that have allowed the company to increase its dividend for 39 consecutive years.

The first of which is its intellectual property portfolio which holds more than 50,000 patents. With its research and development capabilities, Medtronic has been able to build a massive patent portfolio. Every year Medtronic will make use of billions of dollars for R&D:

- The R&D expense for 2014 was $1.5 billion

- The R&D expense for 2015 was $1.6 billion

- The R&D expense for 2016 was $2.2 billion

Essentially a $2 billion R&D budget allows companies to create new innovations that are key to the design and delivery of new products. Intellectual property keeps competitors at bay.

Another competitive advantage of Medtronic is its huge size. Again, if you’re looking for safe stocks with good dividends, it’s worth noting that Medtronic is a “mega-cap” stock with a market capitalization of $120 billion. This size lets Medtronic make key acquisitions and use its scale as a bargaining chip to cut costs. Additionally, Medtronic is in a strong financial position which enables it to raise capital at attractive rates.

All together, Medtronic’s competitive advantages have allowed the company to have a highly advantageous business model and steady earnings each year.

One interesting side note about Medtronic is that it is one of the few companies in the market that actually benefits from a recession-resistant business model. Throughout the Great Recession in the late 2000’s and early 2010’s, Medtronic grew in earnings-per-share each year:

- The EPS in 2007 was $2.61

- The EPS in 2008 was $2.92 (12% increase)

- The EPS in 2009 was $3.22 (10% increase)

- The EPS in 2010 was $3.37 (5% increase)

Dividend Overview

Currently, Medtronic has an annualized dividend payout of $1.72 per share and a dividend yield of roughly 2%. As mentioned, Medtronic has grown its dividend for several years. In 2016, the dividend increase was 13%.

With the company’s earnings power, it’s safe to say that Medtronic’s dividend is quite secure. As reported by fiscal 2017 adjusted earnings-per-share, Medtronic has a payout ratio of 37%.

Yet another reason as to why Medtronic’s dividend is secure is because of the company’s balance sheet. Medtronic has received a credit rating of ‘A’ from Standard & Poor’s, and ‘A3’ from Moody’s.

With a low payout ratio and predicted earnings growth for fiscal 2017, it looks promising that Medtronic will have another strong dividend increase this year.

The Takeaway:

Seeing as Medtronic has increased its dividend for 39 years in a row, it’s almost a given that the company will make it 40 in a couple weeks.

In fiscal 2017, Medtronic forecasted double-digit earnings growth. This would mean that it would pass along a double-digit dividend increase and it would not increase the payout ratio.

All in all, Medtronic investors should expect that the company will increase its dividend by 10% to 15% towards the end of June.

Featured Image: Twitter