Netflix, Inc (NASDAQ:NFLX) shares are volatile after reporting lower-than-expected subscribers growth for the second quarter. Netflix subscriber growth in domestic streaming additions stood around 670K in the second quarter, down significantly from the consensus estimate for 1.21M and far behind the company’s guidance for 1.20M.

Its international streaming additions were at 4.47M in the second quarter as compared to the consensus for 5.06M and its guidance for 5.0M. The lower-than-expected Netflix subscriber growth is contributing to its shares’ small sideways movement over the last two weeks.

Netflix Subscriber Growth Slows but Financial Numbers Are In-line

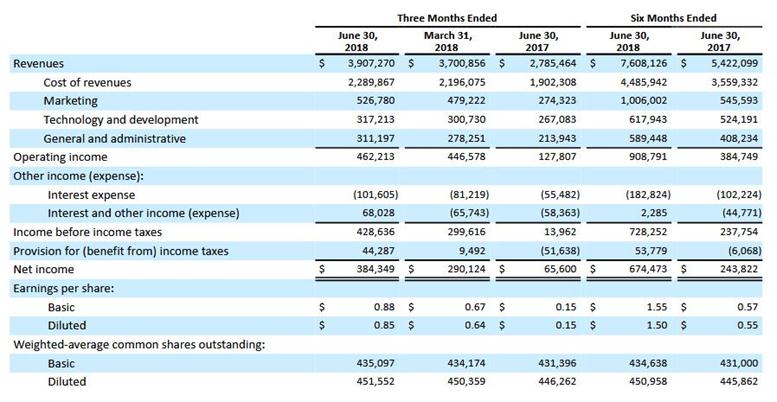

Netflix’s revenue of $3.91 billion for the second quarter jumped 40% since the same period last year. Its earnings also rose substantially from the second quarter of last year, thanks to growth in its operating margin. Its operating margin expanded by 720 bps year-over-year to 11.8%.

Consequently, Netflix’s operating income enlarged 262% compared to the same time last year.

>> Dividend King McDonald’s Corp is Likely to Enhance Shareholders Returns

Reed Hastings, Co-Founder and CEO, said, “Our internet video is growing globally, and we are fortunate to be one of the leaders. In addition to succeeding commercially, we are starting to lead artistically in some categories, with our creators earning enough Emmy nominations this year to collectively break HBO’s amazing 17-year run.”

Netflix Debt and Cash Position

The company’s capital expenditure has been exceeding its operating cash flow generation potential, which is resulting in negative free cash flows. Meaning the company is taking the debt to cover its capital requirements. Netflix’s gross debt jumped to $8.4 billion in the second quarter compared to a cash balance of $3.9 billion.

The company expects its fiscal 2018 free cash flows to stand around -$3 to -$4 billion. Goldman Sachs, however, believes that, in fiscal 2018, Netflix will hit the negative cash flow peak and its free cash flows will slowly recover in the following years; the firm expects Netflix’s free cash flow generation to turn positive by 2022.

Featured Image: twitter