In May, Nike Inc. (NYSE:$NKE) was rebounding from a mid-month low. However, retail investors predict that with overhead resistance it is likely that there will be more price weakness down the road for the athletic footwear, apparel and accessories producer.

Below is a daily bar chart which illustrates the price action over the last 12 months. NKE did well from November to March but quickly turned lower again. In May of this year, Nike Inc. was below the declining 50-day moving average line and below the declining 200-day moving average line. Though the slope of the 200-day line only turned flat in March and April, the slope turned even lower in May.

If you look at the On-Balance-Volume (OBV) line on the chart, you will see only a slight improvement in February and March despite the turn from $49 in November to $59 in March. The 12-day momentum study at the bottom of the chart suggests that momentum is not straying from the price action. The price decline that occurred in mid-April shows no signs of slowing down.

Next, we move on to a weekly bar chart of Nike Inc. Looking at this chart, you can see that prices increased late in 2015. Since the middle of 2016, the slope of the 40-week moving average line has been quite bearish. Since its peak in November of 2015, the weekly On-Balance-Volume (OBV) line has been indicating more aggressive selling. Furthermore, we can see that the weekly Moving Average Convergence Divergence (MACD) oscillator fell below the zero line for an outright sell signal. Despite having some chart support around $50, retail investors are skeptical as to whether or not it will hold.

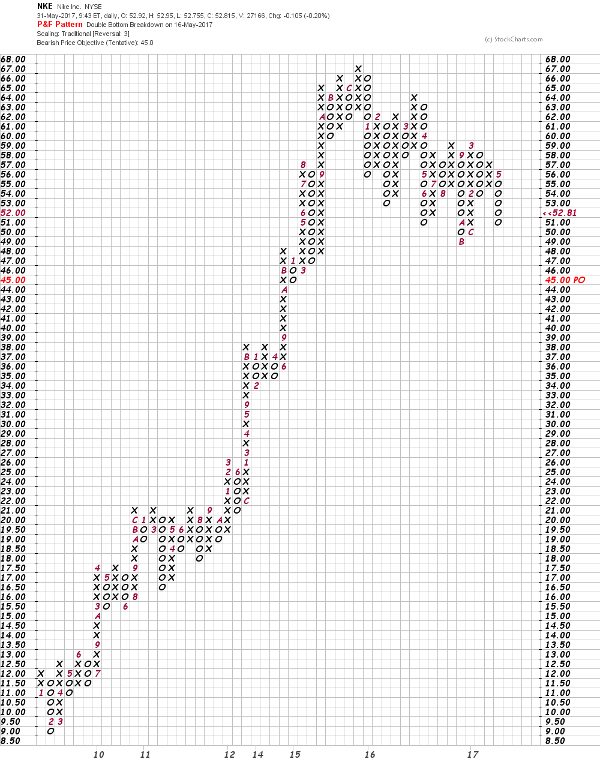

Below is a Point and Figure chart of NKE. Here we can see a downtrend and that $49 is the low trade. If there is a break of $49, there is a good chance that this will lead to a decline to $45 or lower.

The Takeaway: All in all, NKE has had a rough couple of months and it is likely that there will be even more price declines. As mentioned, a break of $49 could mean that there will be a decline to $45 or even $37 in coming months.

Featured Image: Depositphotos/© alexeynovikov