Are you an investor looking for an online discount stock brokerage firm? If so, look no further! One of the best-known online brokers is E-Trade and its known for more than just its marketing practices. ;E-Trade has distinguished features, including easy-to-maneuver trading platforms (browser, mobile, and desktop), an advanced library of educational resources, and various tools that help investors create their portfolio.

If you are an investor who prefers to buy and then hold, don’t be turned off by E-Trade’s commissions not amounting to those at other discount brokerage firms. Commission might not be particularly significant, however, frequent traders tend to appreciate their tiered commission structure.

E-Trade: Did You Know?

- Commission amounts to $6.95, with volume discounts available

- The account minimum is $500

- With a deposit of $10,000 or more, you can receive 60 days of commission-free trades

When Should You Use E-Trade?

- E-Trade is best if you are a frequent trader or beginner investor

- It can be used for commission-free exchange-traded funds

- Often used for research and acquiring data

- Assisting in retirement planningAreas in Which E-Trade Excels

Trading platforms

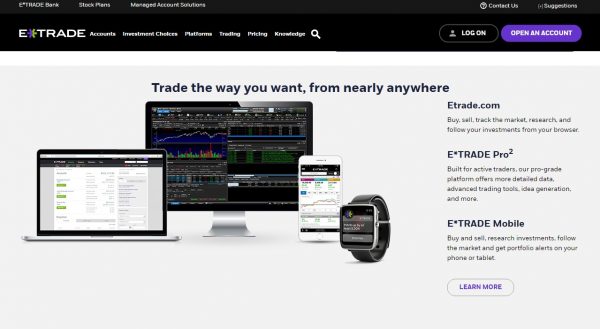

When working with E-Trade, you have the option of two trading platforms. There is E-Trade Web and E-Trade Pro, as well as an app for mobile phones. First, let’s dive into E-Trade’s web platform. This platform offers free market data, market commentary, real-time quotes and analyst research stock screeners. On the dashboard, an individual is able to track their accounts, look at market data, formulate “watch lists” and make trades.

E-Trade Pro, on the other hand, is where the company really outdoes itself. This trading platform has been designed for more the active trader. Just keep in mind however, that to gain access, an individual has to maintain, at the very least, an account balance of $250,000. Additionally, an individual can gain entry to this platform by conducting at least 30 stock or options trades per quarter.

This platform includes tools such as the company’s Strategy Scanner, a professional-level options screener, back-testing capabilities, and customizable charting.

Even more impressive is that an individual is able to personalize both platforms to create a workspace that is best suited to their needs and interests. If you are looking for more information on the functions of each platform, check out the E-Trade website as there are a variety of educational materials and demos available.

Mobile phone app

Claiming the title of the best mobile app for an online broker, E-Trade’s free mobile app is unlike any other. Available for iOS, Android, Amazon and Windows Phone, E-Trade’s app allows an individual to manage their account, make trades and get quotes, charts, and CNBC Video on Demand. Furthermore, if you have an iPhone or Android, you will have even more features such as stock and ETF screeners, options chain filters, and educational videos.

Transaction fee-free mutual funds: Offering 2,500 transaction fee-free mutual funds, E-Trade’s analysts create a quarterly All-Star List, bringing to light the top no-load funds and ETFs offered. Keep in mind that, similar to most brokers, E-Trade will charge an early redemption fee on no-load, no-transaction-fee funds that are held for less than 90 days ($49.99) as well as a short-term trading fee (roughly $15.99 to $19.99) on sales of specific ETFs if they are held for less than 30 days.

Educational resources and customer support: Mentioned previously, E-Trade is a great option for beginner investors as it offers a variety of educational resources, including online presentations on retirement planning, analyzing trade ideas, and stock market basics. By utilizing these resources, an individual is able to learn how to build their portfolio, how to determine risk, and how to decide which product is worth investing in. Additionally, with more than 30 branches staffed by financial consultants, E-Trade has exceptional in-person customer service.

Transaction fee-free mutual funds

Offering 2,500 transaction fee-free mutual funds, E-Trade’s analysts create a quarterly All-Star List, bringing to light the top no-load funds and ETFs offered. Keep in mind that, similar to most brokers, E-Trade will charge an early redemption fee on no-load, no-transaction-fee funds that are held for less than 90 days ($49.99) as well as a short-term trading fee (roughly $15.99 to $19.99) on sales of specific ETFs if they are held for less than 30 days.

Educational resources and customer support

Mentioned previously, E-Trade is a great option for beginner investors as it offers a variety of educational resources, including online presentations on retirement planning, analyzing trade ideas, and stock market basics. By utilizing these resources, an individual is able to learn how to build their portfolio, how to determine risk, and how to decide which product is worth investing in. Additionally, with more than 30 branches staffed by financial consultants, E-Trade has exceptional in-person customer service.

If you are an investor looking for even more guidance on how to construct a portfolio, make sure you check out E-Trade’s ‘My Virtual Advisor’ tool. This tool provides free asset allocation recommendations for ETF, self-directed fund, and stock investors.

Looking to pursue more hands-on management? Check out E-Trade’s robo-advisor service. This will execute trades for you and adjust your portfolio’s holdings for an annual advisory fee. With that said, you have to invest a minimum of $10,000 for the robo-advisor.

Disadvantages of E-Trade

Commission

Even though E-Trade’s commissions are on the higher side of the spectrum ($6.95 per trade), certain competitors like TradeKing and OptionsHouse will be at more of an advantage than E-Trade as they offer a flat $4.95 trade commission.

Jumping through hoops to access E-Trade Pro

To access the premium trading platform, individuals have to have a certain number of trades or a minimum account balance ($250,000). As a result, customers tend to look elsewhere if they cannot meet the minimum requirements. If you find yourself in the same boat, you might prefer TD Ameritrade, Trade Architect, or thinkorswim.

What It Comes Down To

All in all, if you are an investor of any kind, chances are you will benefit from E-Trade’s investing tools, wide selection of commission-free ETFs, retirement planning resources, and transaction fee-free mutual funds. Though there are plenty of advantages, the biggest drawback of E-Trade has to be its commission rates. Keep in mind however, if you are a frequent trader, you probably won’t be affected to much by the commissions as you will benefit from the tiered pricing. To quote Arielle O’Shea of NerdWallet Investing, “E-Trade’s high trade commissions are balanced by its quality platforms and research.”

Photo by torbakhopper / CC by