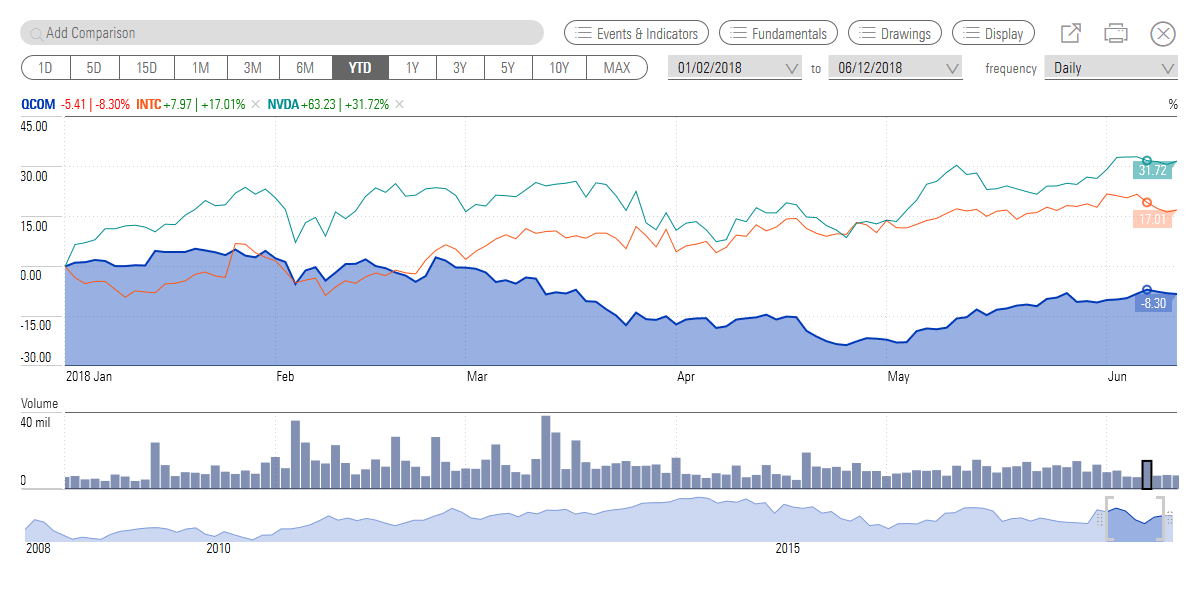

Albeit booming demand for chip and processor makers, Qualcomm (NASDAQ:QCOM) is standing far behind Intel (NASDAQ:INTC) and NVIDIA (NASDAQ:NVDA) regarding share price and financial performance. While QCOM share price is down 8% year to date, its two closest peers have generated double-digit gains for investors.

Source Image: morningstar.com

Qualcomm, which develops and licenses the wireless technology and also designs chips for mobile phones, fails to entice investors through its product line and financial numbers.

NVIDIA and Intel’s Financials are Better than Qualcomm

Qualcomm has generated revenue growth of only 6% in the latest quarter, and its earnings dropped 50% from the year-ago period. NVIDIA and Intel, on the other hand, are generating high double-digit revenue growth. Their earnings are also increasing at higher pace. Moreover, NVIDIA expects its revenue to grow in the range of 50% this year.

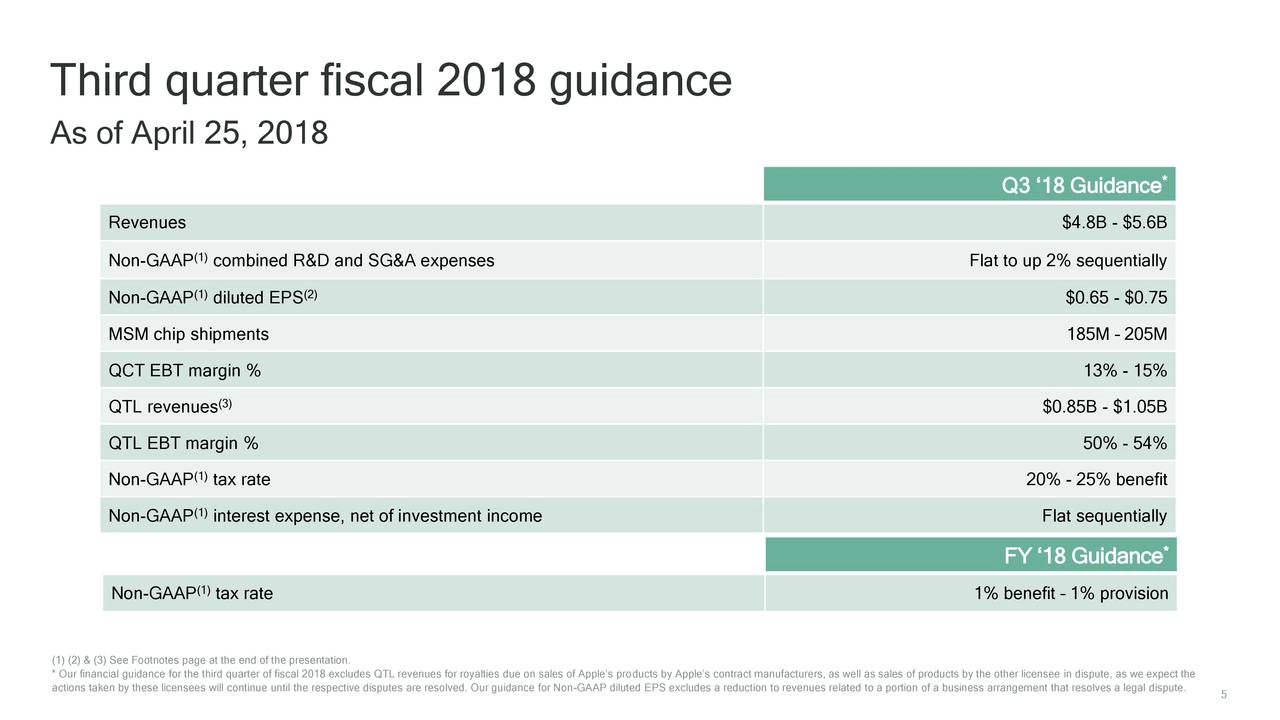

Qualcomm has also lowered its revenue and earnings guidance for the full year due to lower demand for its products.

QCOM expects Q3 revenues in the range of $4.8B, significantly lower from the lower end of previous a guidance of $5.6B and the consensus estimate of $5.28B. QCOM has also presented downside EPS of guidance of $0.65 from an earlier outlook for $0.75.

Analysts aren’t Convinced with its Growth Initiatives

Qualcomm has been betting on its strategy of reducing their operating costs by $1 billion along with the pending acquisition of NXP and the potential for global commercialization of 5G. The company has also been offering increasing cash returns to investors despite dim outlook. It has recently increased its quarterly dividend by 8.8%. Its dividend yield of 4.5% stands at the higher end of the industry average.

Market analysts, however, are showing their concerns over the company’s performance and the potential to compete with its peers. Stifel reduced Qualcomm’s stock price target to $54 from $56. The firm has also declined their earnings expectations of FY2019.

Featured Image: Twitter