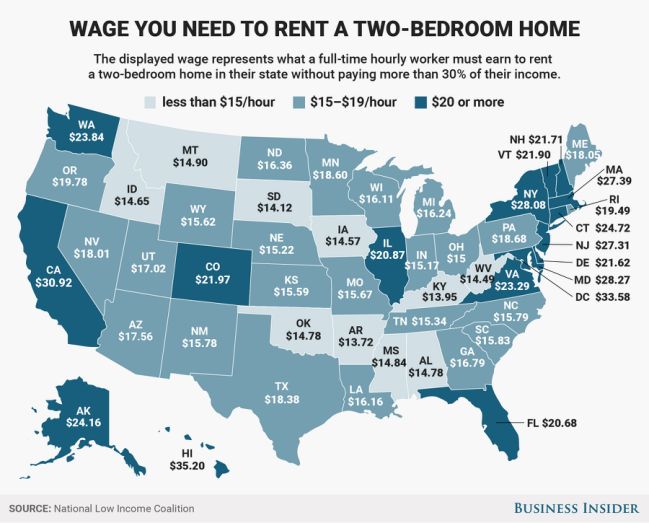

If you live in the United States, and you want to rent a two-bedroom home, you will need to make $21.21 per hour as a full-time worker. However, if you are looking to live in New York or Maryland, that figure is considerably higher as these are the states suffering the most from the United State’s affordable housing crisis.

The National Low Income Housing Coalition released a report which illustrated what an hourly worker will need to make in order to afford to live in a two-bedroom rental home — without having to pay more than 30% of their income — in each state. The report includes Washington, DC and Puerto Rico. Like most things, it will depend on the location, but the hourly wages required for housing could range from $9.68 (Puerto Rico) to $35.20 (Hawaii) for those that work 40 hours every week, 52 weeks every year.

(Important note: The report does not take into consideration the 37 localities, or the urban growth boundary of Portland, Oregon, with minimum-wages that are higher than the traditional state or federal wage. There are no local minimum wages that are enough to afford to live in a one-bedroom unit at FMR with a 40-hour work week)

This map is a blunt reminder that the majority of Americans, especially low-income Americans, are unable to afford to rent even a decent home.

In order to rent a two-bedroom home, the average wage needed ($21.21) is roughly three times more than the federal minimum wage of $7.25. According to the Bureau of Labor Statistics, there are over 2 million US workers that either make or are below the federal minimum.

However, some states are worse off than others. For instance, as reported by HUD’s Fair Market Rents estimates, in Maryland the average two-bedroom costs $1,470 per month. If a renter wants to sign a lease, that individual would have to make $28.27 per hour. Now, some people might that this is doable, but wait until you hear this: Maryland’s hourly minimum wage remains at a whopping $8.75.

Additionally, the report takes into consideration the availability of affordable housing in counties dispersed around the United States. The report suggests that there are only 12 counties in the US where minimum-wage workers are able to afford one-bedroom units. To no surprise, these counties are all in states that have minimum wages above the federal standard: Oregon, Arizona, and Washington. Places such as California and DC have major urban housing markets, thus making them more susceptible to larger deficits of affordable housing.

Even if Americans are able to start making above minimum wage, chances are they won’t feel like they are in the clear with rent – let alone ready to start saving for retirement or their children’s education.

Featured Image: depositphotos/ersler