The era of the multi-brands-under-one-roof department store may well and truly be over. Adding to the list of struggling ones, a Sears closure is on the way with the company closing a further 46 stores across its Kmart and Sears (NASDAQ:SHLD) retail outlets.

UK icon, House of Fraser (LON:HOF), has also been recently toeing the line of complete closure.

Sears Closure: 46 Stores

But what’s going on with Sears? Already this year, the company has closed more than 100 stores, inclusive of the last remaining Sears in Chicago. This is a poignant action considering Chicago is the company’s hometown but desperate times call for desperate measures, and the retailer needs to stem its loses.

Of the 46 stores to close, 13 will be Kmart stores and 33 will be Sears stores. Employees have already been notified and the closure is expected to happen in November with liquidation sales beginning in some stores as early as August 30th.

Earlier Days

Kmart and Sears merged in 2005, at a time when online shopping was nowhere near as prevalent as it has now become. Between them, they had about 3,500 US stores.

Today, only about 900 US stores remain and more closures are very likely.

The company’s decline began around 2010 and it has lost a massive $11.2 billion USD—which represents a 60% sales plunge—since then.

In a recent statement the company stated:

“We continue to evaluate our network of stores, which is a critical component to our integrated retail transformation, and will make further adjustments as needed.”

Can It Be Saved?

With other department stores equally looking for an escape plan, can Sears really turn it around?

Downsizing and focusing on its premium brands could be a good start; in order to raise capital, it has been looking at selling some of these assets. Sears Holdings still owns the Kenmore brand and that brand is considered widely valuable even if Sears itself is not.

>> China Responds to Trade Tariffs By Dropping US Coal

Eager to hold onto the potential of Kenmore, Sears company CEO and majority shareholder Eddie Lampert offered to buy the appliance brand for $400 million along with the Sears Home Services division for between $70-80 million.

This deal has not been confirmed yet but Sears did sell the Craftsman tools brand to Stanley Black & Decker (NYSE:SWK) last year in a $900 million deal.

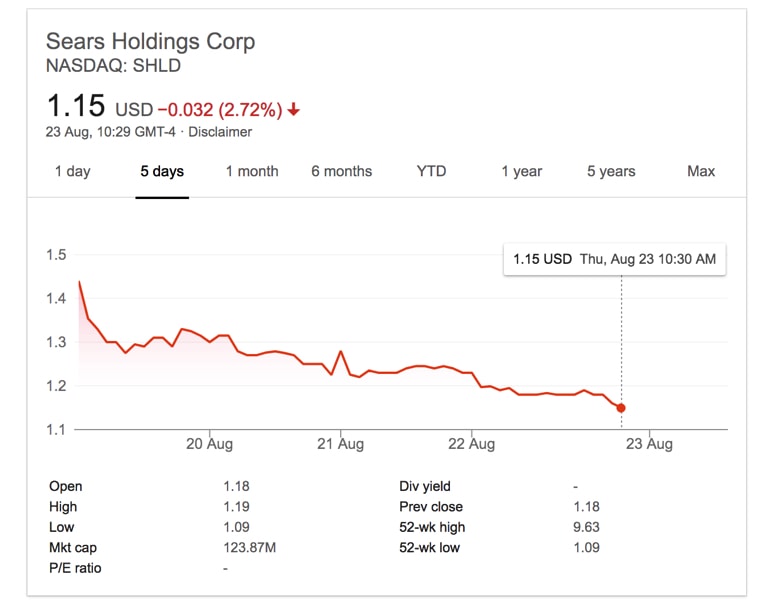

Sears shares have been plunging and continue to decline; currently down 2.72% and at $1.15 a share:

Featured Image: Deposit Photos/wolterke