Are you an actively engaged options, stock or futures trader seeking a high-quality trading experience? If so, look no further as TradeStation is one of the top choices for investors. Over the years, TradeStation has gone from working with only brokers, hedge funds and money managers to now allowing regular investors to access their trading platform, analytical tools and vast archives of research data.

If you are tech/media savvy or an active investor, chances are you will not be turned off by the minimum balance requirement of $5,000 for a regular brokerage account or the $30,000 minimum for a pattern day trading account. Additionally, if you are an investor who qualifies for the volume commission discounts that TradeStation offers then you can look forward to working with one of the top trading environments.

TradeStation: Did You Know?

- The commission’s rate is a flat fee of $5. Based on trading activity, it will be $0.0006 to $0.01 per share.

- The account balance minimum is $5,000

- If you are a new account, you can save 20% on commissions

When Is The Right Time To Use TradeStation?

- TradeStation is best if you’re an advanced trader, stock, options, futures trader, or an active stock trader

Ongoing Promotion

If you create an account with TradeStation, you can save 20% on commissions, roughly up to $1,500.

Areas in Which TradeStation Excels

Tools and platforms

Known for its desktop platform, TradeStation offers tools that let clients customize their trading strategies for futures, option, and stocks. They also offer a method of executing trades without having to input them manually (a trade executed without a dealer) as well as giving investors a way of interacting with the order book of an exchange.

If a client is looking to test out new strategies without having to put real money on the table, they can use the TradeStation Simulator. TradeStation has another tool called EasyLanguage which lets the more tech-savvy clients design their own trade strategies and then they have the option to sell them to other TradeStation clients via the Trading App Store. If you are an options investor, you will love the free access to their OptionsStation Pro platform.

Access to research

TradeStation lets clients back-test strategies and ideas by using 90 years of historical market data as well as intraday data. TradeStation has 150 indicators in their platform, with more being able to be created or downloaded.

Educational resources and community support

This company has both a TradeStation University and a TradeStation Lab. At the University, they offer a variety of free video tutorials, articles, and ebooks and customers are able to access briefings and interviews at the labs. If you are looking for further support or a second opinion, check out the TradeStation Trader Wiki for tips from other TradeStation customers. For those unsatisfied with the tips presented on Trader Wiki, you can join a discussion forum with a community of investors.

Disadvantages of TradeStation

Exchange-traded funds and mutual funds

Despite TradeStation offering a variety of ETFs, it will not offer commission-free ETFs or any research on exchange traded funds. Same goes for mutual funds. TradeStation will offer clients close to 4,900 funds, but none of them will be no-transaction-fee funds. Just keep in mind though that TradeStation’s mutual fund commission rate of $14.95 is in line with other brokerages.

Trading platform fees

In March of 2017, TradeStation lowered its commission rates and got rid of the monthly service fees for their mobile, desktop and web-trading apps. They also included free access to their RadarScreen tool and access to market data from firms that once required a monthly subscription.

Commission confusion

Despite TradeStation offering three different pricing plans, if you choose a plan, you are only allowed to switch to another one once.

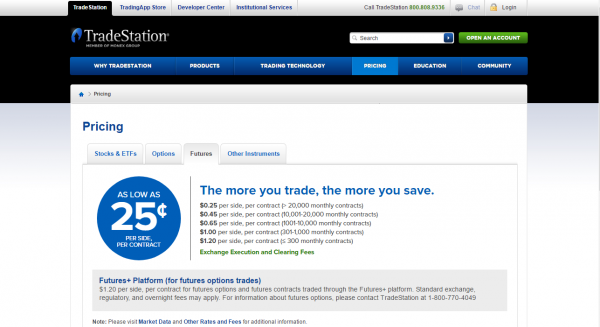

If you are an average trader, you will find the $5 commission rate for stocks and $5 base rate with $0.50 per contract considerably reasonable. For active traders, TradeStation’s per-share/per-contract commission plan is much more attractive. For the first 500 shares, a stock/ETF investor will pay $0.01 per share with a minimum $1 per trade. After that, investors are required to pay $0.006 per share. If you are an options trader, expect to pay $1 per option contract (with no base charge or ticket charge) and a minimum of one contract market order.

What It Comes Down To

As TradeStation has served brokers, institutional investors, and hedge funds for over three decades, this firm has become a standout for traders and investors.

If you are new to the world of trading and looking for a balanced learning curve, check out brokers such as OptionsHouse, Interactive Brokers, and TD Amertitrade’s thinkorswim.

Featured Image: tradestation-international.com