Today, telephone service company Windstream Holdings, Inc. (NASDAQ:$WIN) reported second-quarter earnings and announced that its board of directors reviewed the company’s capital allocation strategy.

The board’s revision was announced in a separate release from its dismal Q2 earnings.

According to the announcement, the Windstream board has gotten rid of the company’s quarterly shareholder dividend effective immediately. Further, the board authorized the repurchase of up to $90 million of the company’s common stock. This will be effective through Q1 of 2019.

After the fortune 500 company eliminated its dividend Thursday morning, there was a 27% decline in its share price. As of noon EDT, Windstream Holdings stock was trading at $2.73, which is a $1 decline in share price.

Here are some key stats from Windstream Holdings second-quarter earnings report:

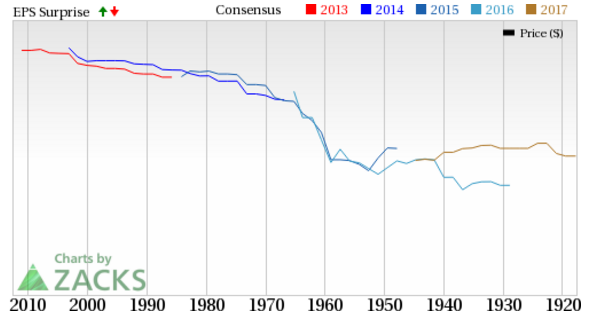

- Windstream Earnings: The company reported narrower-than-expected net loss in Q2 of 2017. Based on the Nasdaq consensus estimate, Windstream was forecast to report a loss of 45 cents per share, and eventually came in at a loss per share of 37 cents. It’s important to note that these figures do not include stock option expenses.

- Windstream Revenue: Windstream posted total revenue of $1,491.6 million, which lagged the Nasdaq estimate of $1,499 million.

- Key Stats: At the Q2 end, Windstream Holdings had 1.0258 million high speed internet subscribers. Additionally, they had 0.3007 million digital TV customers.

Featured Image: twitter