Keep the following in mind if you are thinking about investing in technology.

Apple Inc. (NASDAQ:$AAPL) used to be the largest information technology company by revenue in the world, but as of late, the California-based company has entered into a bit of a rough period. Over the last two trading sessions, Apple shares have lost a combined 6.2% and if that wasn’t enough, short sellers have increased their positions to $9.1 billion, which is up 54% so far this year and coming close to the 2017 high of $9.7 billion, according to S3 Partners.

The majority of Apple shareholders entered into panic mode on Monday when Mizuho Securities became the second firm in a week to downgrade the technology company from a buy to neutral. The Japanese investment banking firm has remained loyal to their decision and the firm does not seem to believe that there is an upside for Apple.

The sell-off that took place on Monday captured $335 million in mark to market gains for short sellers, which took losses for 2017 back towards $1 billion. As mentioned, Apple is a California-based technology company, but they are also members of a group of tech giants who have continued to outperform the Nasdaq exchange in 2017. That said, FAANG stocks, which is an acronym for the five most popular tech stocks in the market, lost a combined total of $126 billion in two trading days.

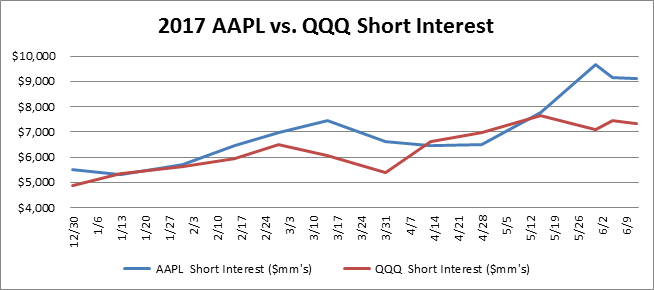

According to Ihor Dusaniwsky of S3 Partners, “AAPL’s increase in short interest is not a case of the tech tide lifting all boats.” Elaborating further on the topic, Dusaniwsky added, “While short interest in both AAPL and the Powershares QQQ Nasdaq 100 ETF (QQQ US) traded in tandem for most of the year, we can see an obvious divergence in mid-May. While QQQ short interest fell by $316 million, or 4%, since May 15th, AAPL short interest increased by $1.3 billion, or 17%, since May 15th.”

As reported by S3 Partners, Apple is the third-biggest short stock in the market, trailing behind Alibaba Group ($BABA) who has $16.7 billion in short interest, and Tesla Inc ($TSLA), who saw short interest cap $10 billion last week.

Featured Image: twitter