If you’re interested in computer hardware stocks, you might want to pay attention to the following: Networking hardware company Cisco Systems, Inc. (NASDAQ:$CSCO) reported earnings for Q4 of its 2017 fiscal year today. And after the news, the stock dropped 2%.

A Brief Summary:

– Earnings Per Share: 61 cents in earnings per share versus 61 cents in earnings per share as forecast by analysts, according to Thomson Reuters.

– Revenue: $12.1 billion versus $12.06 billion as forecast by analysts, according to Thomson Reuters

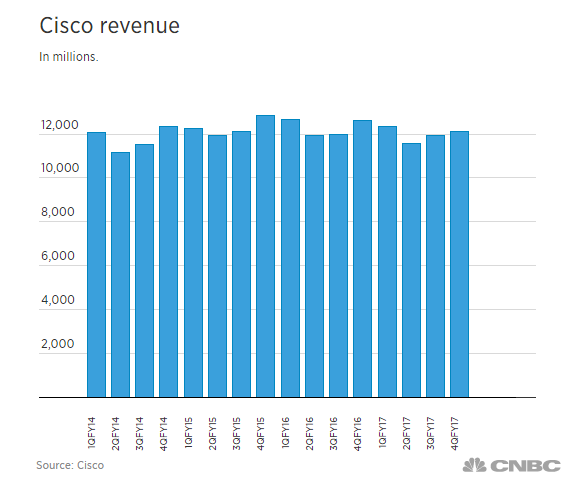

Revenue for the company has now dropped on an annualized basis for seven straight quarters. That said, Cisco has still surpassed earnings and sales estimates for every quarter since CEO Chuck Robbins took over two years ago.

In regards to guidance, Cisco said for Q1 of the 2018 fiscal year, it forecasts 59-61 cents in earnings per share on 1 to 3 percent less revenue than it received for the 2016 quarter. According to Thomson Reuters, analysts were forecasting 60 cents in EPS and $12.05 billion in revenue for guidance for the current quarter.

In addition, Cisco announced that it repurchased roughly 38 million shares of common stock at an average of $31.61 per share for a total of $1.2 billion.

For those who don’t know, Cisco tends to get most of its revenue by selling data center switching and routing hardware. And according to the company, switching and next-generation routing revenue, totaling $5.3 billion, dropped 9% year over year.

In this quarter, Cisco disclosed that it would be cutting 1,100 people from its employee list. Further, the company revealed a subscription-based networking security service.

Featured Image: twitter