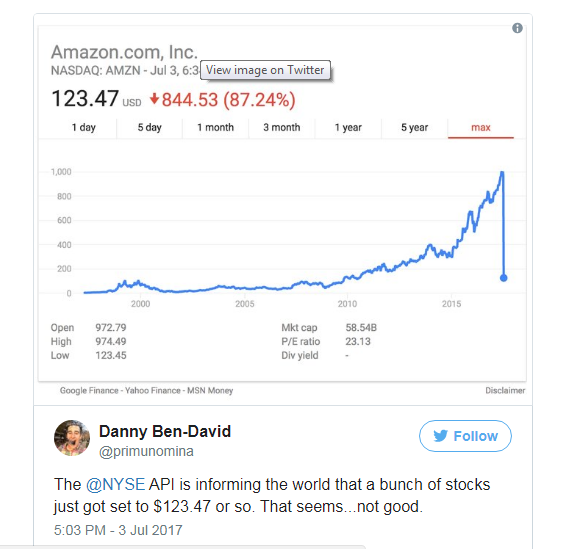

On the evening of July 3, there was a stock market data error which placed an undetermined number of companies listed on the Nasdaq exchange to a share price of $123.47. As a result, a number of tech companies’ stock prices crashed, while others skyrocketed. The Financial Times obtained a statement in which Nasdaq stated that the source of the error was “improper use of test data” that was picked up by third party financial data providers. According to the exchange, it has been “working with third party vendors to resolve this matter.”

Despite not knowing when it all started, the error was replicated across key financial websites, such as Bloomberg, Yahoo Finance, and Google Finance. However, we do know that stock notifications for tech companies started to flood in at some point during the evening of July 3. To no surprise, this resulted in a number of tweets on the matter.

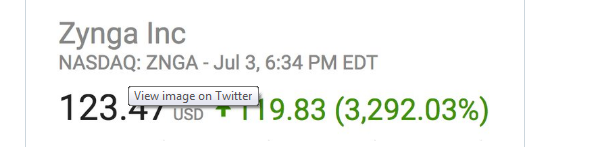

Mentioned previously, the error on the Nasdaq exchange either caused a company’s stock to crash or to soar. Amazon Inc. (NASDAQ:$AMZN), for instance, was one company that witnessed a catastrophic effect on the appearance of its market capitalization. Following the error, Amazon went down 87%. On the other side of the equation, Zynga (NASDAQ:$ZNGA) saw the error as good news as they went up 3,292%.

Featured Image: Twitter