The coronavirus pandemic has affected markets significantly, with many stocks taking a beating over the past month. Semiconductors stocks were not spared and have been on a downward trend as the crisis increases concerns of a slowdown in demand for chips. Since there are growing concerns about the impact the coronavirus pandemic will have on the global economy, semiconductor investors are starting to become worried.

Last year, semiconductor stocks witnessed a significant rally and were poised to continue surging this year on the prediction that demand for chips could recover this year. However, things haven’t turned out the way most people expected, and concerns of a collapse in chip demand have continued to grow as the global economy slows. As a result, semiconductor stocks have been on a downward trend in the past month, just like the rest of the market.

For instance, the Philadelphia Semiconductor Index, which comprises some of the largest semiconductor companies, dropped over 18% in the first quarter—that’s the largest quarterly loss in nine years! However, when considering the broader picture, the situation is not all that gloomy for some chipmakers. Some chipmakers are doing well because of new demand dynamics, product diversification, and strong balance sheets. Here are 3 semiconductor stocks to keep an eye on:

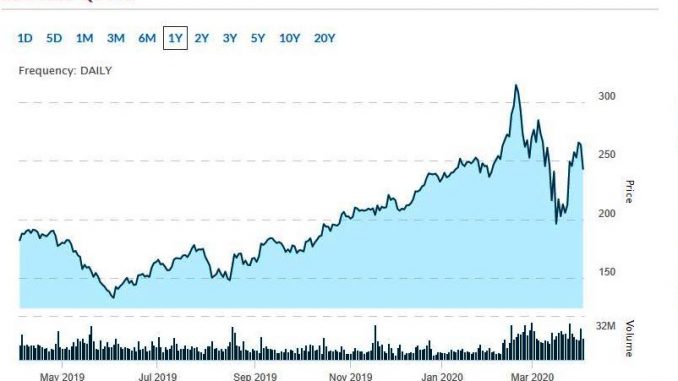

3 Semiconductor Stocks All Set to Outperform This Quarter: Nvidia Corp (NASDAQ:NVDA)

Nvidia stock surged 76% last year, and currently, it is performing better than its rivals amidst the ongoing sell-off. The stock is up over 12% year-to-date and has outperformed the Philadelphia Semiconductor Index.

Although slowing demand might hit the chipmaker because of the coronavirus lockdowns, analysts will be looking at its product categories, cash flow, and balance sheet, which are expected to be strong during this crisis. For instance, Needham has upgraded Nvidia stock to “buy,” predicting a surge in demand for chips employed in medical applications and AI technologies.

Similarly, Susquehanna Financial Group upgraded its price target for the stock by $10 to $330, citing strong enterprise demand, as well as alleviation of supply constraints. The firm added that the growing trend of remote-work has helped demand of cloud-computing chips.

>> 3 Popular Tech Stocks to Watch in April 2020

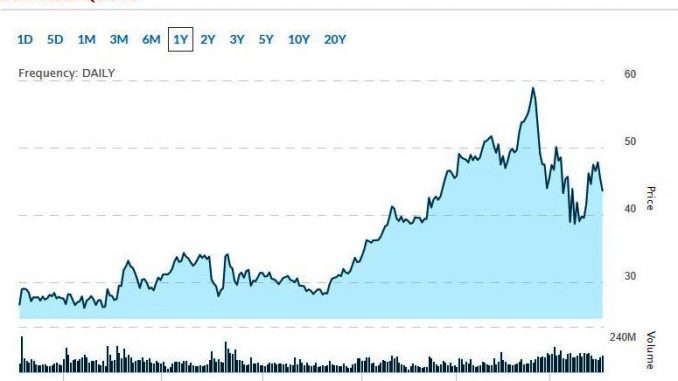

3 Semiconductor Stocks All Set to Outperform This Quarter: Advanced Micro Devices (NASDAQ:AMD)

Another stock touted to perform well once the current crisis is over is Advanced Micro Devices. Last month, Northland Capital Markets indicated that this is one stock to own after the coronavirus crisis, and they upgraded it to “outperform.” In a note, the firm indicated that a change in consumer behavior will boost game console sales beginning the second half of 2020. Also, they noted that there will be strong demand in the data center segment.

Recently, AMD CEO Lisa Su dispelled concerns about the impact of COVID-19 on the profitability of the company. She said that the PC supply chain has been recovering, and the company’s suppliers in Malaysia, Taiwan, and China are nearing full output. The company is maintaining its near-term revenue prediction of $1.8 billion, with a range of plus or minus $50 million. However, results might be on the lower end of the range because of weakened business in China.

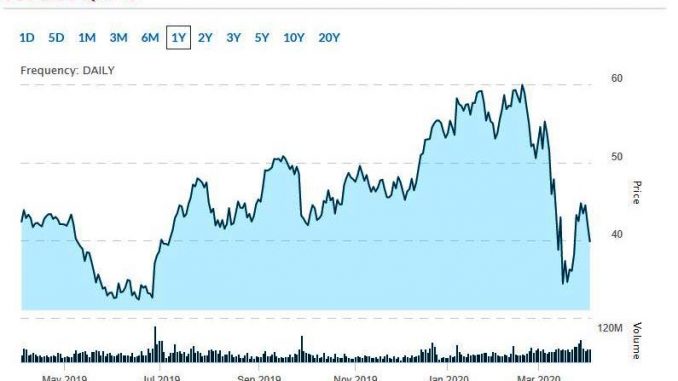

3 Semiconductor Stocks All Set to Outperform This Quarter: Micron Technologies Inc. (NASDAQ:MU)

In the last two weeks, Micron stock is up 38% after it hit a 52-week low of $31.13 in mid-March. The company specializes in dynamic random-access memory (DRAM) chips that are commonly used in servers and PCs.

The stock has caught the attention of investors because of the view that demand for chips for data centers is likely to surge to address the bandwidth requirements of gaming, remote working, and e-commerce during this coronavirus crisis. Similarly, there is optimism that the chipmaker will see an increase in demand for chips from notebook manufacturers as online learning and remote working becomes a norm.

Last week, the company delivered strong Q2 earnings results. The company announced earnings of $0.45 per share on revenue of $4.80 billion, topping analysts’ projections of EPS of $0.37 on revenue of $4.69 billion. In Q3, the company expects earnings to be between $0.40 and $0.70 per share and revenue to be between $4.6 billion and $5.2 billion.

What to Do Now?

Although the coronavirus pandemic has impacted markets, these 3 semiconductor stocks have been able to do relatively well during this crisis. Once the crisis is over, many believe they are poised for growth and will be in a position to leverage long-term demand prospects for chips. They are definitely worth keeping an eye on.

Featured image: Pixabay