Following William Stein’s upgrade, shares of Nvidia Corp. (NASDAQ:$NVDA) climbed to a record close on the back of a six-session win streak on Wednesday. The SunTrust Robinson Humphrey analyst said that he underestimated the growth potential in its core markets. Stein, who has been covering the stock since September of last year, increased his rating from ‘hold’ to ‘buy’. At the same time, he raised his price target to $177, which is 8.9% above current levels, from $124.

The California-based company’s stock increased 4.3% to close at $162.51, exceeding the previous record close of $159.94 that was reached on June 8. The all-time intraday high ($168.50), reached on June 9, was still 3.7% away. Since it last declined to close at a seven-week low on July 3, Nvidia’s stock has since increased 16.3%.

Stein took full responsibility and acknowledged the fact that he was “not early” in turning bullish on Nvidia. However, he doesn’t believe he’s too late to profit. According to Stein, it’s likely that the stock will continue to outperform the broader market over the next year. Why? Mostly because of the upside potential for earnings and sales across most divisions, but even more so in the data center for artificial center space. Additionally, Nvidia’s role as a key player in the cryptocurrency mining markets has also played a defining role in investor optimism.

In a letter to his clients, Stein wrote: “While we have been keenly aware of [Nvidia’s] growth opportunities in the data center, gaming and automotive end markets in the year since we launched coverage, we’ve under-forecasted the growth potential in these markets,” He added, “Yes, [Nvidia] is widely loved, but there are aspects of the company we think are underappreciated.”

According to Stein, Nvidia’s success stems from three key factors:

- The company has a strong culture of innovation as well as the longing to drive general purpose graphics processing unit computing adoption.

- Nvidia has a software development toolkit which is much more relevant for customers and harder for competitors to replicate.

- Nvidia has developed an “ecosystem of incumbency” in deep learning artificial intelligence applications via its sponsorship of academic research.

“Collectively, these factors provide [Nvidia] with a deep & wide moat in the data center for Al applications, when compared to both traditional and emerging competitors,” Stein explained.

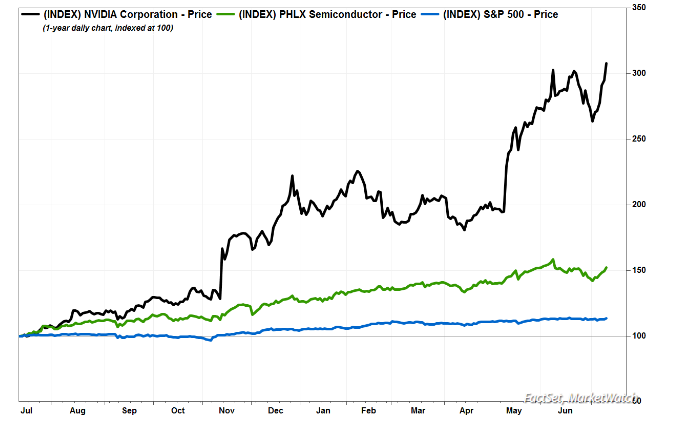

Over the past year, Nvidia’s stock has more than tripled, in comparison to the 52.1% rally in the PHLX Semiconductor Index and the S&P 500 index’s 13.5% rise.

Featured Image: Twitter