In 2016, Zinc, which is a silver and white metal used to coat Steel and Iron, gave a tremendous performance with roughly 60% gains on the London Metal Exchange as well as the Merchant Customer Exchange. However, so far, the zinc price forecast for 2017 has predicted that this will be a difficult year for this non-ferrous metal.

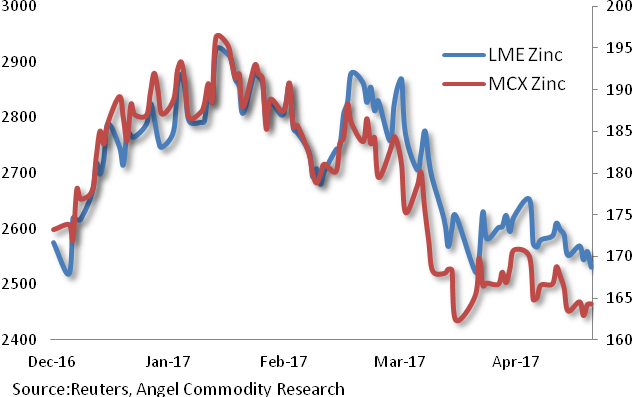

Falling to the fourth position, London Metal Exchange Zinc has gains of only 1.5% while Merchant Customer Exchange Zinc prices have decreased by 2%. In early 2016, in an attempt to put pressure on polluting industries, the mainland nation promised to cut 150 million tons of excess capacity by 2020. China pledged similar output cuts, cutting 65 million tons in 2016 and 31.7 million tons in 2017 alone.

That said, following a 1.2% increase to 808.4 million tons in 2016, Chinese steel output, which accounts for half the globe’s production of steel, rose 4.6% in the first quarter of 2017 to 201.1 million tons.

Despite this, the actions of the People’s Bank of China has hurt the demand for the ferrous metal. In an attempt to calm down the property market, the People’s Bank of China has taken hostile and aggressive actions, which has hurt zinc supply and lowered Zinc prices from an average of $2782/t in December of 2016 to $2682/t in May of 2017.

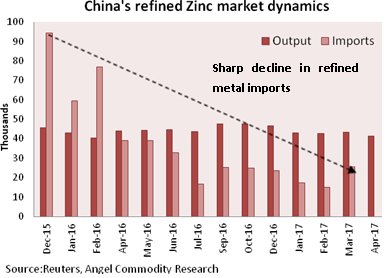

This decline can be seen by looking at China’s Refined Zinc market dynamics and looking at their zinc supply. Imports of zinc have plummeted 68% from 180,985tonss in the first quarter of 2016 to 57,986 in the first quarter of 2017.

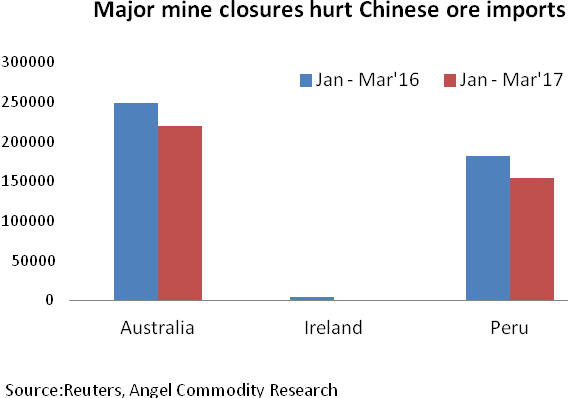

According to the National Bureau of Statistics most recent data, China’s zinc output has fallen from 43,400 tons in March of 2017 to 41,300 tons in April of 2017. Additionally, the Chinese market has been impacted by the closures of major zinc mining companies as well as the decrease in production of refined metal. This decline followed the 2016 closure of 2 important zinc mining companies: Australia’s Century mine and Ireland’s Lisheen mine.

Statistically speaking, this indicates that China is likely to step up on imports of zinc supply amidst dwindling supplies of concentrate. The head of metals at a China commodity trade house stated, “we should see some opportunities for refined metals.”

As of the 20th of May’17, Shanghai Zinc stocks are at 91,749 tons. This is the lowest it has been since January of 2015. Additionally, Shanghai Zinc stocks have declined by 41% since the 23rd of April 2017. This indicates that traders are now moving towards exchange stocks due to the lack of concentrates supply. Similar occurrences have happened for LME in 2017, with zinc stocks plummeting by roughly 20%.

According to the 2017 zinc price forecast predicted by the International Lead and Zinc Study Group, the global demand for refined zinc metal will surpass zinc supply by 226,000 tons. After a 3.1% growth in 2016, the market is likely to be encouraged by a 2.6% demand increase to 14.30 million tons in 2017.

Given the refined market and the stock decrease at both Shanghai warehouses and LME, there is a good chance that the zinc price forecast will improve in the upcoming months. It is expected that zinc prices will move towards Rs. 180-185/kg mark in the upcoming term.

Featured image source: DepositPhotos/© panayot