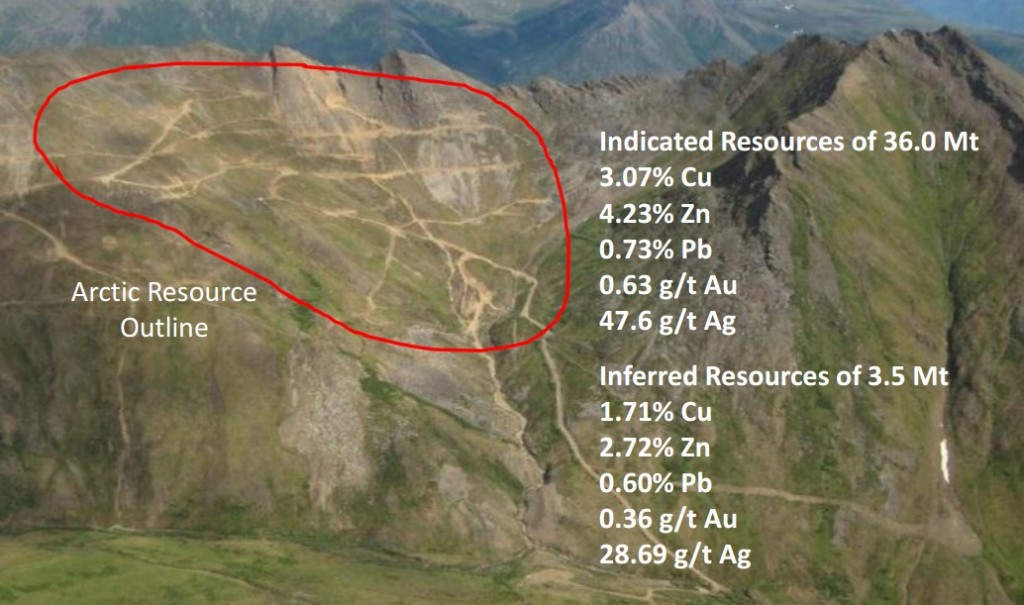

If you are interested in zinc mining companies, then you, along with the rest of the world, will be amazed at Trilogy Metals’ ($TMQ, $TMQ.TO) latest resource update at the Arctic Zone in Alaska. As of right now, this deposit is likely to contain a pit-constrained resource of 36 million tons at an average grade of 3% copper, 4.23% zinc, 0.73% lead, 0.63 grams per ton, and roughly 1.5 ounces of silver per ton of rock.

Even if you’re new to the zinc market, you should be able to recognize that average grades such as the ones mentioned above are quite impressive. Despite the Arctic deposit being located in the middle of nowhere (fingers crossed that road construction which is meant to unlock the Ambler district will start up soon), these average grades will allow for anything to work. Plus, average recovery rates have maintained 92% for copper and 88% for zinc, with both concentrates having a strong average grade. This, in turn, will cause premium pricing.

These updates will also cause an interesting turn of events for South32 (ASX:$S32, $S32.L), a base metal and coal mining company in Western Australia. South32 has formed a 50/50 combined venture with Trilogy on its assets in Alaska. Under the terms of this agreement, South32 will have to pay $10 million per year for the next 3 years in order to keep the venture in good standing. The initial $10 million, for instance, will be spent on the Bornite deposit, while the cash from the next three years will be used to further the Arctic project.

Once these three years come to an end, South32 can exercise the option and pay $150 million in an attempt to acquire a 50% stake in Trilogy’s assets. This is likely to happen as the management team for Trilogy believes that this $150 million will be enough to cover a variety of expenses.

Featured Image: Twitter