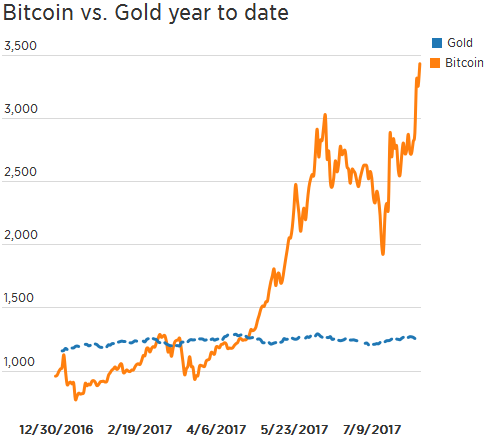

It’s been quite the day for the cryptocurrency market. And if you’re interested in cryptocurrency trading, pay close attention to the following: BitcoinBitcoin Soars to record high record highs this week which put the digital currency close to being triple the price of gold.

“Our initial bitcoin report viewed bitcoin as a ‘store of value’ and over time would be seen as an alternative to gold,” Thomas Lee of Fundstrat said. Last month, Lee became the first major Wall Street strategist to write a bitcoin report, called ‘A framework for valuing bitcoin as a substitute for gold.”

On Tuesday, in afternoon trade, Bitcoin traded close to $3,487 after reaching an all-time high of $3,525.04 earlier in the day, according to CoinDesk. To put this into perspective, that’s less than $300 away from triple the price of gold. For December delivery, gold futures settled $2.10 lower today, at $1,262.60 an ounce.

According to CoinDesk and FactSet data, Bitcoin’s first cross above the price of gold in 2017 on a closing basis was on March 2. And based on Tuesday’s price, Bitcoin has more than tripled for 2017, versus gold’s almost 10% rise.

“I think bitcoin is going to have increasing institutional sponsorship given the pending trading of bitcoin options and bitcoin futures,” said Fundstrat.

Both products – bitcoin options and bitcoin futures – are forecast to launch later on in 2017 or early next year. That being said, gold will not be disappearing as a store of value.

Lee mentioned that the overall size of the gold market is roughly $7.5 trillion dwarfs that of bitcoin. With Tuesday’s prices, Bitcoin had a market cap of almost $57 billion. For context, this is around the size of Charles Schwab.

With this, Lee pointed out that even a measly percentage of fund flows out of gold into Bitcoin could send the digital currency’s price higher. This could potentially be into the tens of thousands of dollars in the next few years.

It’s worth mentioning that other digital currencies also increased Tuesday. For instance, Ethereum traded almost 5% higher at $280, which is roughly 12% higher for the month, according to CoinDesk data.

Featured Image: depositphotos/spaxiax