According to Societe Generale (EPA:$GLE) and RBC Capital Markets (TSE:$RY), the rebalancing of the oil market is an ongoing process, despite it is happening at a slower than expected pace.

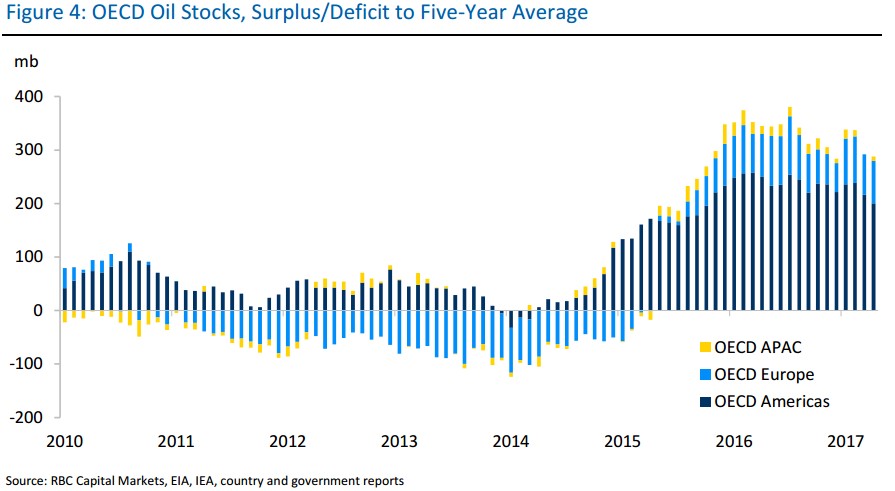

In November, OPEC first agreed to cut output, and there were many that hoped that the six months of reduced oil production would be enough to rebalance the market. However, according to Societe Generale, OECD crude and product stocks were 56 MM barrels higher at the end of April than they were at the end of December. It is thought that OPEC was forced to continue cuts, and most of these cuts were agreed to at the end of May.

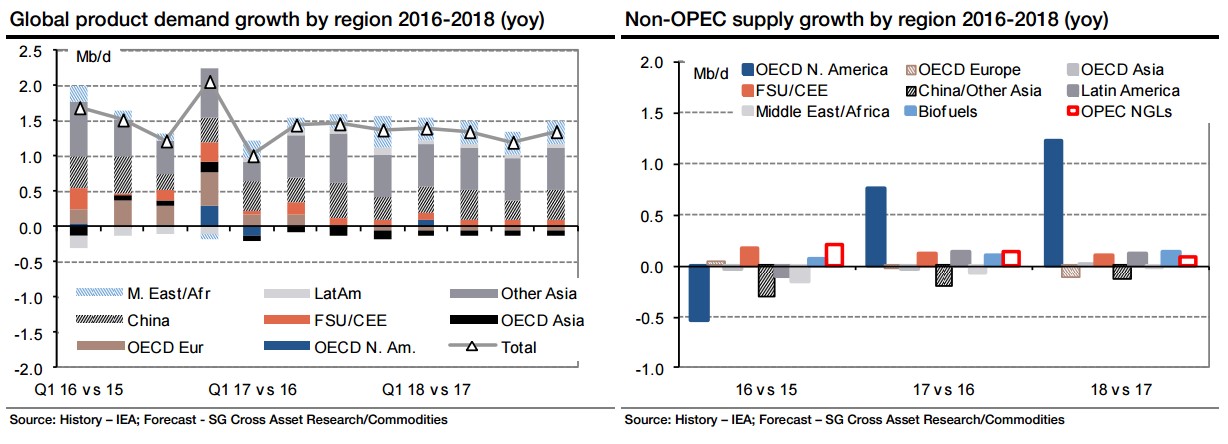

According to Societe Generale, oil stocks will begin to drop throughout the rest of the year, if the agreement to continue output cuts is maintained. Based on reports, the demand for oil worldwide is expected to grow by 1.3 MMBOPD in 2017 and 2018. When you factor in increased demand and the decreased output from OPEC, this will mean that the drawdown is 0.6 MMBOPD in 2017 and in 2018, 0.5 MMBOPD.

For both 2017 and 2018, most drawdowns will occur in the second half of the year.

Though it may not be obvious to the public eye, inventories are already decreasing, according to RBC. As of right now, the total OECD oil stocks are roughly 280 MMBO higher than the current five-year average. With that said, this is mostly due to the United States American stocks accounting for roughly 70% of excess storage. As a result, RBC predicts that the United States will be the last region to have a rebalance in the oil market. However, keep in mind that RBC does expect stocks to balance out eventually, most likely in mid-2018.

It’s important to note that due to the slow drawdown on global inventories, both firms have changed their predicted oil prices and decreased what they had originally thought. In 2017, Societe Generale expects WTI to average $53.80 and $57.50 in 2018. RBC sees similar prices, with $53/bbl in 2017 and $59/bbl in 2018.

Following this, oil prices will increase over the course of the next few years to roughly $75/bbl. This is because investment in massive projects requires an increase in pricing, according to Societe Generale’s assessment.

Featured Image: Depositphotos/© 3dmentat