For some investors, Chevron (NYSE:$CVX) is a great stock to invest in when it is declining in order to be rewarded by the stock’s long-term recovery. As well, despite not having quite enough cashflow to cover its dividend, Chevron’s dividend isn’t overextended.

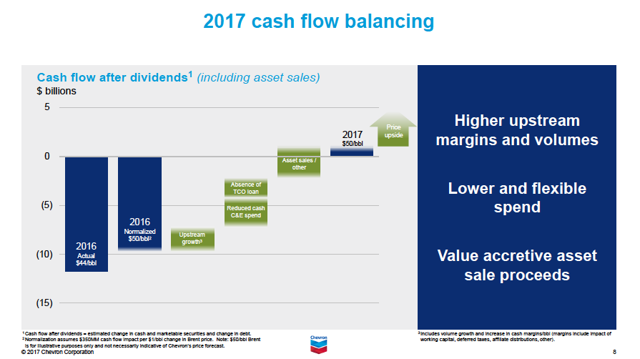

In order to see a good amount of free cash flow for the oil-producing giant, crude oil prices will need to be at $50 per barrel. Once that happens and remains steady, the potential of benefitting from investing in Chevron will increase dramatically. Until then, investors are still rewarded with a dividend payment that carries a 4% yield.

Attention To Free Cash Flow

Given current market environments, several analysts believe that oil and gas companies will need to keep a high amount of free cash flow to better protect against price uncertainty. There is still a chance for the price of crude oil to continue to cruise lower due to increase in American production and buildup in inventories.

In its Q1 reports, Chevron saw $3.9 billion in operating cash flow and spent $3.31 billion in capital expenditure, leaving its free cash flow at $590 million. This is barely enough to cover Chevron’s total dividend payment of $2 billion. If capital expenditure falls in between $17-21 billion this year, Chevron could see a negative free cash flow of around $1 billion in 2017.

Assuming flat pricing of oil continues, Chevron could overspend by $9 billion in 2017 after paying its dividends. Of course, as previously mentioned, the amount Chevron overspends could lower significantly if oil prices improves and get to be around $50 per barrel. Investors should still be prepared for the possibility of Chevron’s second quarter report to see minimal free cash flow, as it is likely oil prices will not reach $50 per barrel.

Chevron’s main problem is free cash flow after paying dividends. While this could raise some red flags for investors — especially those who believes Chevron won’t be able to protect itself from price uncertainty — some investors don’t feel the need to worry. While low cash flow can affect how well Chevron can return value to its shareholders, Chevron also has an economic moat worth almost $7 billion.

Asset sales can also be considered when it comes to lowering the impact dividends can have on Chevron’s free cash flow. In its first quarter report in 2017, Chevron saw a $2.1 billion in asset sales — leaving around $5.1 billion in planned asset sales this year.

It should also be noted that the reported capital expenditure for Chevron’s first quarter in 2017 is the lowest the company has seen in awhile. In 2014, capital expenditure averaged almost $10 billion a quarter, and in 2015 capital expenditure was an average of around $8 billion per quarter. Other costs that eats into revenue like operating costs are also decreasing — since 2014, it has gone down by 26%. As well, Chevron has been pretty good at paying dividends, keeping an 8% compound annual growth rate for the past 10 years.

Possibilities of Breaking Out

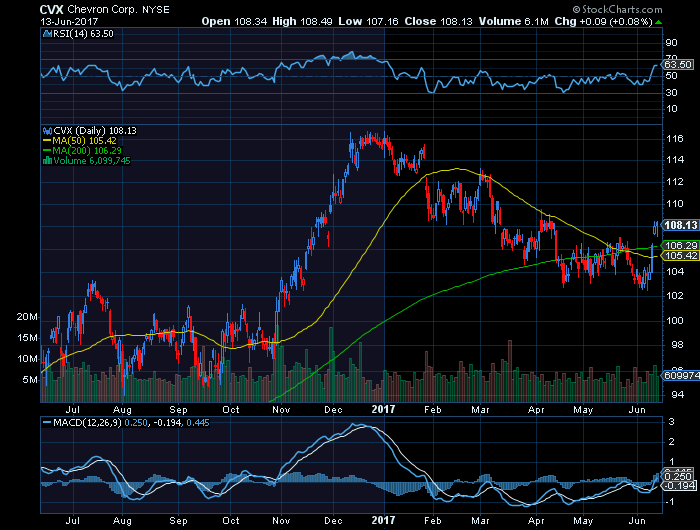

Although Chevron may be seeing trouble from its limited cash flow, its stocks broke away slightly from the downward trend about two weeks ago. The numbers were just slightly above the company’s 50 and 200 day moving averages (DMAs). However, after closing at around $108 on Friday, June 16, stocks went down again — closing most recently at around $104 on Wednesday, June 28. Still, the high Chevron’s stock met about a week ago was the first time its went above its 50 day moving average in 2017, a positive sign to investors.

It may seem like a stretch, but if Chevron’s stocks can somehow rise back to $116 — where it was in the beginning of 2017 — shareholders could have a return of 7.2% before dividends. For now, it looks as if the return potential for the second half of 2017 could be around 10%.

Still, everything is dependent on the price of crude oil. If oil prices manage to hit above $50 per barrel, not only could Chevron gain back some free cash flow after dividends, Chevron’s stock could also trade at a price up to $130.

Summary

Although free cash flow for Chevron was positive in the first quarter, this can very well change once the company pays out its dividends. Even without dividends, however, Chevron looks like it may still end up with negative free cash flow in 2017 due to high capital expenditure and the low prices crude oil is currently experiencing.

As many companies await eagerly to see if oil prices can go above $50 per barrel, Chevron should take it a quarter at a time — looking to lower costs and how to better manage outflows.

Featured Image: chevron