Whatever information was released last week at Tesla’s (NASDAQ:$TSLA) annual shareholder meeting last week, investors in the company seem to be happy with the rising company. Tesla’s stock continues to rise after its 3.7% growth in the week ending June 9, 2017 — as of now, shares are up about 3% today. Besides the anticipation of its electric cars, Tesla has also begin to play a part in producing sustainable energy.

As Tesla’s stock rose, its value has surpassed giant tech and automobile companies such as Ford (NYSE:$F) and General Motors (NYSE:$GM). Now, Tesla’s value has become higher than one of the most high-end automobile companies, BMW (NASDAQOTH:$BAMXF). Last Friday, Tesla’s market capitalization was almost half a billion dollars more than BMW. The success, however, was short-lived as Tesla’s stock stopped gaining, causing the electric-car/sustainable energy company’s market capitalization to go back below that of BMW’s. Today, however, Tesla saw its market cap rise above BMW once again by almost half a billion currently. Take note, though, as the fall that happened on Friday could happen today as the market closes and Tesla’s stocks slow down its gain.

Why is Tesla’s stock gaining so much?

At its shareholder meeting last week, Tesla co-founder and CEO Elon Musk reaffirmed to investors that the company is currently on track for its Model 3 launch in July. Not only that, the CEO also showed confidence in the company’s upcoming products such as the Tesla semi, Model Y. Musk also teased that an unannounced product could be uncovered this year, displaying confidence in that product as well.

Besides upcoming products, Tesla’s biggest goal to reach still currently lies within its ambitious production of the highly-anticipated Model 3. Besides the thousands of Model 3 reservations that were bought via deposits, Tesla also hopes to produce 500,000 Model 3’s next year. This is a large leap compared to the 84,000 Model 3’s produced last year. However, the company remains confident in the fact that it will reach its production goals even with the launch date for the vehicle being only a month away. As such, investors have also remained confident in Tesla — resulting in a continuous rise in stock price.

Think carefully before investing

Because of its continued rise in stock prices, many investors are lured into a false sense of security when it comes to Tesla’s shares. Investors are still warned to — like any other company they wish to invest in — research and consider the risks before buying a Tesla stock. The fact that it has been overperforming should give investors reason to remain cautious when it comes to Tesla’s shares. As well, because of its high stock price, the company could have limited potential for significant growth in the future. Tesla is also not reporting its profits regularly yet — as such, its valuation is just assuming that the company could eventually gain profits similar to BMW, and is not a surefire thing.

BMW’s profit margins are unusual for an automobile company: a gross profit margin of around 20% and a net profit margin of around 8%. Compared to Ford’s gross profit margin of around 16% and its net profit margin of 2%, as well as General Motor’s gross profit margin of around 13% and its net profit margin of around 6%, BMW’s profit margins are extremely high.

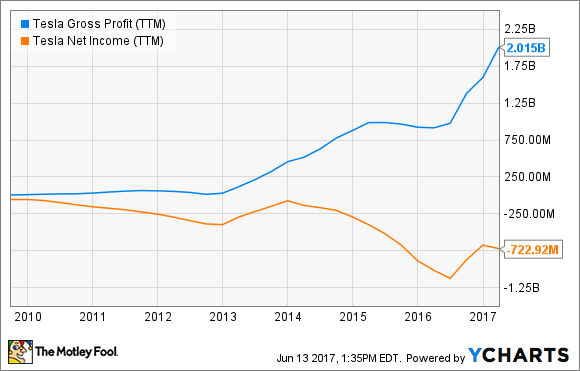

As such, Tesla’s gross profit margin has gone beyond that of BMW, General Motors, and Ford at an impressive 24%. However, the company has been losing quite a lot due to operating expense thanks to its ambitious expansions of retail, service, charging networks, factories, and production capacity. In the last 12 months, Tesla lost $723 million to its operating expenses from the company’s $2 billion in gross profit. To add further concern, the Model 3’s starting price is half of the Model S and Model X, which could mean that gross profit margin will spiral down.

Looking at its profits long-term, however, Tesla addressed concerns over Model 3’s lower starting price with the belief that high demand will allow for the company to gain gross profit margin with the vehicle. It projected that the Model 3’s gross margin should be similar to that of Model S and Model X.

Sales are ultimately set to rise as Tesla brings in new products, but investors should beware that mass-market production is still a relatively new area for the company. This can cause for some risk regarding the stock, despite its high rates.

Featured Image: twitter